Offshore bookkeeping is entering a new phase of maturity. Firms are no longer outsourcing only for lower cost. They want scalability, predictable delivery and a structured workflow that allows distributed teams to work as one unit.

More than 70 percent of US CPA firms now offshore some portion of their bookkeeping and accounting workload. Firms that combine offshore teams with workflow platforms report reducing month end close duration by around 40 percent and cutting revision cycles by more than 60 percent once visibility improves.

The technology stack behind those results typically looks the same. Xero or QuickBooks Online as the ledger. Double (formerly Keeper) as the workflow engine. Offshore teams as the capacity engine.

Why Xero and QuickBooks Online are not enough on their own

Running remote bookkeeping through spreadsheets, email and chat tools creates friction and risk once teams span multiple time zones. The three most common operational gaps are:

- Delayed handoffs because work status is hidden in email threads

- Quality issues that surface late in the close cycle

- Lack of standardization across team members and clients

When firms depend only on ledger tools:

- Review feedback is reactive

- Accountability is unclear

- A large portion of work movement happens manually

Double fills this workflow gap by organizing month end close work on top of live ledger data and centralizing tasks, communication and quality controls in one interface.

Where Double fits in the offshore bookkeeping tech stack

A modern distributed bookkeeping firm often builds around this structure:

Ledger layer

Xero or QuickBooks Online for financial records

Workflow layer

Double for assignments, close checklists, transaction queries and reporting visibility

Communication layer

Client portal and integrated email inside Double

Team structure

Onshore review and offshore execution following standardized templates

Some firms try to manage offshore teams with general project tools like Asana, Monday or ClickUp combined with Xero or QBO. These tools work for general planning but they lack accounting specific features such as two way ledger sync, transaction level visibility and built in close templates. Teams then spend time updating multiple systems, which reduces the benefit of offshore leverage.

Double is purpose built for bookkeeping firms. This is why offshore first firms adopt it rather than relying only on generic task platforms.

How two way sync changes the offshore workflow

Double connects to QuickBooks Online and Xero with live two way sync. In practical terms:

- Tasks completed in Double update the ledger

- Ledger changes appear in Double without manual export

- There is no duplicate data entry

- Reviewers do not need to jump between multiple tools to see the real position

For offshore teams working overnight, two way sync removes waiting time. When the US office begins its day, completed work is visible instantly instead of sitting in exported workbooks or email attachments.

Data from firms that have implemented this model shows:

- Monthly close reduced from fifteen days to about eight days

- Rework and revision cycles cut by about sixty percent because errors are caught earlier

- Review time per client down by roughly thirty to forty percent since work arrives structured and visible

These gains explain why Double adoption is growing among remote first bookkeeping firms.

Double features that solve offshore pain points

Structured close workflow

Repeating task templates replace ad hoc instructions. Offshore staff follow the same checklist for each client profile which improves consistency and reduces training time.

Full visibility across clients and teams

Managers can see status by client, by assignee or by task phase. This transparency replaces manual update calls and reduces micro management when teams are spread across locations.

Transaction level client questions

The client portal links questions to individual transactions instead of sending long email threads. Clients respond in one place. Offshore and onshore teams always see the full context.

For firms designing remote setups, the article on remote accounting workflow design is a useful companion resource.

Built in quality checks

Double highlights uncategorized, duplicate or unusual items before final review. Problems are surfaced during the workflow instead of at the year end or during an audit.

When this is combined with SafeBooks internal controls and security practices explained in How SafeBooks Protects Client Financial Data, firms gain both visibility and assurance.

Reporting at scale

Standard report packs can be created and reused. Offshore bookDoubles generate monthly packs directly from Double and the ledger, which keeps output consistent and reduces manual formatting work.

Security and access control for global teams

Security is often the main concern when firms consider offshore staffing. Double supports a layered security model:

- Role based permissions so offshore staff see only assigned clients and tasks

- Detailed audit trails that record who changed what and when

- IP and access controls that can limit login locations

- Separate access models for internal users and clients

SafeBooks adds another layer with strong internal controls, secure operating environments and encrypted data transfer policies. Combined, these controls often provide better protection and traceability than fully manual, email based workflows inside a single office.

For a broader look at the risk side of offshore staffing, see How Safe Is Offshore Staffing.

How SafeBooks Global works inside a Double plus ledger stack

Not all offshore providers are designed to fit inside an existing workflow system. Some insist on parallel tools and separate processes, which creates duplication and weakens control.

SafeBooks was built around a different idea. Offshore teams should integrate into the firm’s infrastructure, not force the firm into a new ecosystem. That means working directly inside:

- The firm’s Double environment

- The firm’s Xero or QuickBooks Online files

- The firm’s documented close templates and client protocols

Key points that set SafeBooks apart:

- BookDoubles and controllers already experienced in Double, Xero and QBO

- Onboarding that maps work to existing templates rather than rewriting everything on day one

- Clear division of execution tasks and final review or advisory tasks

- Respect for data and tool ownership, which always remains with the firm

Firms that want deeper context on offshore partner selection can also review How To Evaluate An Offshore Accounting Partner.

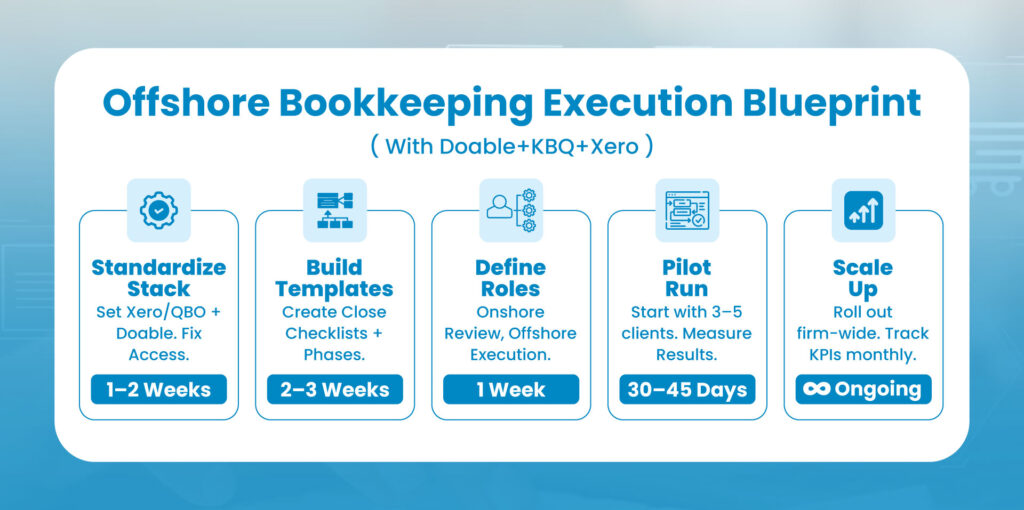

Five stage implementation blueprint

Stage 1: Standardize the stack

- Confirm Xero and or QuickBooks Online as your primary ledgers

- Select Double as the central workflow tool for bookkeeping

- Clean up user access and permissions across all tools

- Document the official tools that teams must use

You can compare this structure with the broader view in Best Tech Stack For Offshore Accounting Firms.

Stage 2: Build close templates

- Create close checklists for common client types

- Group tasks into logical phases such as pre close, reconciliations and review

- Attach internal notes or micro guides to complex steps

- Standardize naming so teams can understand the workflow at a glance

Stage 3: Assign onshore and offshore roles

- Decide which tasks belong to offshore staff and which stay with onshore reviewers

- Set deadlines that respect time zone differences

- Clarify who can communicate directly with clients through the portal

- Make accountability visible inside Double, not only in written policies

Stage 4: Run a controlled pilot

- Start with three to five clients and a small offshore pod

- Track time to close, number of revisions and client satisfaction

- Identify steps that still rely on manual work or side channels

- Refine the templates before wider rollout

Stage 5: Scale across the portfolio

- Extend the model to more clients once the pilot data is strong

- Use Double dashboards to spot bottlenecks and training needs

- Review metrics regularly and keep improving templates instead of adding manual checks

Expert Insight

“Firms often think the main offshore question is headcount. In reality, the more important question is whether your workflow and review structure can handle that extra capacity. When Double sits on top of Xero or QuickBooks Online and you combine that with a disciplined offshore team, you gain visibility, traceability and control that many fully local firms still lack.”

-Shivangi Agrawal

Managing Director (CA, CPA USA), SafeBooks Global

Scaling offshore bookkeeping successfully is not just about adding people. It is about building a system where work flows smoothly, reviews happen in real time, and quality remains consistent across time zones. When Double sits on top of Xero or QuickBooks Online, and SafeBooks supports the execution layer, firms gain structure, visibility, and reliability that traditional models cannot offer.

The result is a predictable month end close, faster turnaround, fewer revisions, and a confident client experience.

If you want to review how this workflow can fit your firm, schedule a strategy call below: Start your Double workflow assessment

FAQS

Do I need Double if I already use Xero or QBO with a project management tool

Will security be compromised if offshore teams get access to Double and my ledgers

Who should own the Double environment when working with SafeBooks

What bookkeeping work should move offshore first inside Double

Can SafeBooks help design workflows if our process is not standardized yet

-

Director (CA, CPA (USA))

Shivangi is a U.S.-certified CPA and Chartered Accountant with deep expertise in U.S. tax, financial reporting, and audit compliance. She has supported CPA and EA firms across sectors like real estate, SaaS, and healthcare. At SafeBooks, she leads global delivery, ensuring every remote accounting team meets U.S. standards with accuracy, discipline, and client-first execution.