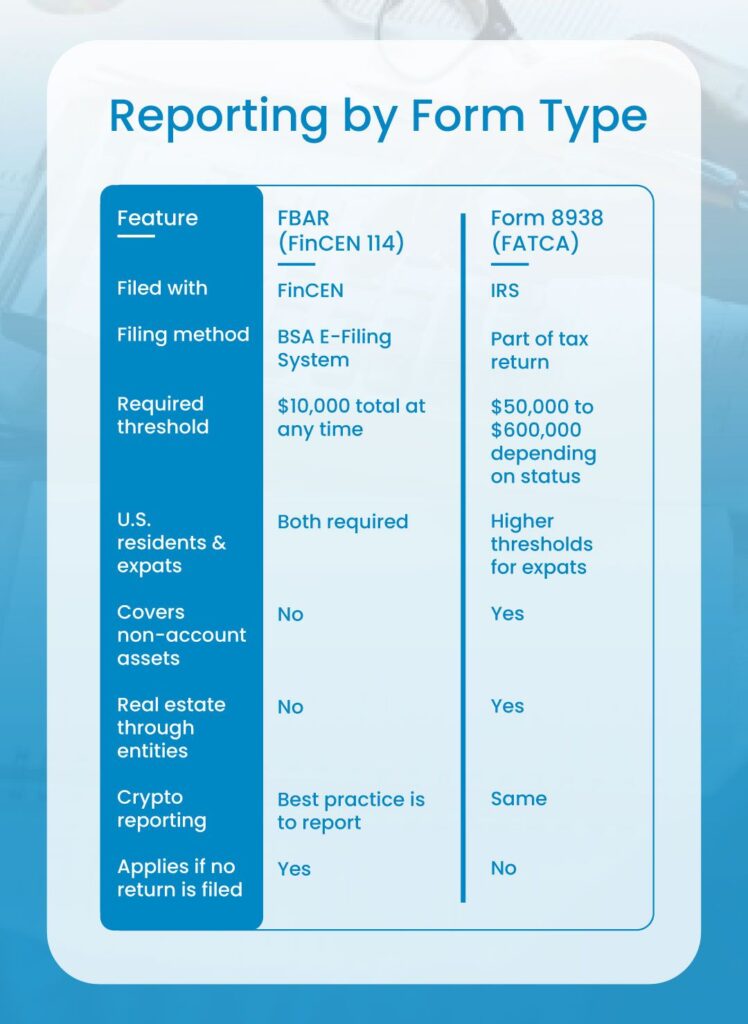

If you’re a U.S. CPA or tax professional working with clients who hold foreign financial assets, you’ve likely encountered confusion between FinCEN Form 114 and IRS Form 8938. Both forms deal with foreign accounts and both come with serious penalties if ignored. But they serve different purposes, follow different rules, and apply in different scenarios.

This guide breaks down the differences in plain language, so you can help your clients stay compliant and audit-ready in 2025.

FinCEN Form 114: Reporting Foreign Accounts to Treasury

FinCEN Form 114, also known as FBAR, is required under the Bank Secrecy Act. It is filed with the Financial Crimes Enforcement Network, not the IRS.

Who Needs to File FBAR?

Any U.S. person must file an FBAR if they had a financial interest in or signature authority over foreign financial accounts that had a total value of more than $10,000 at any time during the calendar year.

A “U.S. person” includes:

- U.S. citizens

- Green card holders

- U.S. residents

- Domestic partnerships, corporations, LLCs, trusts, and estates

Importantly, FBAR applies to U.S. persons even if they live abroad. This differs from FATCA, which allows higher thresholds for expatriates.

What Needs to Be Reported?

FBAR covers foreign financial accounts, including:

- Bank and brokerage accounts

- Foreign pensions and retirement plans

- Foreign life insurance policies with cash value

- Foreign mutual funds

FinCEN’s official FBAR instructions outline what counts as a reportable account.

Filing Process and Deadline

The FBAR must be filed electronically through the BSA E-Filing System. It is due April 15, with an automatic extension to October 15. It is not filed with your tax return.

IRS Form 8938: FATCA Asset Disclosure with Your Return

Form 8938 is required under the Foreign Account Tax Compliance Act (FATCA). It is part of your tax return and submitted to the IRS. Unlike the FBAR, it applies only if you are required to file a tax return.

Who Must File Form 8938?

U.S. taxpayers must file Form 8938 if they meet both of these conditions:

- They are required to file a federal income tax return

- Their specified foreign financial assets exceed certain thresholds

The thresholds vary depending on filing status and residency:

| Filing Status and Residency | Year-End Threshold | Any Time During Year |

| Single, U.S. resident | $50,000 | $75,000 |

| Married filing jointly, U.S. resident | $100,000 | $150,000 |

| Single, expat | $200,000 | $300,000 |

| Married filing jointly, expat | $400,000 | $600,000 |

The IRS FATCA FAQ further explains these thresholds.

Many U.S. citizens working abroad mistakenly classify themselves as residents. This is one of the most common audit triggers and a reason firms use SafeBooks’ offshore bookkeeping and documentation teams to reduce risk.

What Assets Are Covered?

Form 8938 includes:

- Foreign bank and brokerage accounts

- Foreign-held stocks and bonds

- Interests in foreign partnerships or trusts

- Foreign retirement plans

- Foreign life insurance and annuities

- Real estate held through a foreign entity

This form goes beyond just bank accounts.

2025 Update: Crypto and Digital Assets

While FinCEN has not yet finalized FBAR rules for cryptocurrency, the current conservative best practice is to report foreign-held crypto accounts if their total value exceeds $10,000. This aligns with industry updates from CoinLedger and other compliance platforms.

This includes crypto wallets held at foreign exchanges, decentralized platforms, or apps without U.S. custody. CPAs should advise clients to disclose these holdings and maintain documentation to support reporting decisions.

Comparing FBAR and Form 8938

Valuation Rules

For FBAR, report the highest balance shown on any monthly or periodic account statement during the year. Do not rely on year-end balances.

For Form 8938, report fair market value at year-end. If unavailable, make a good-faith estimate and document your approach.

The IRS Form 8938 instructions offer valuation methods and exchange rate guidance.

Penalties for Non-Compliance

FBAR

- Non-willful violation: up to $10,000 per form

- Willful violation: the greater of $100,000 or 50 percent of the account value

- Criminal penalties may apply

As clarified in Bittner v. United States (2023), FBAR penalties apply per form, not per account.

Form 8938

- $10,000 base penalty

- Additional $10,000 for every 30 days after IRS notice (up to $50,000)

- 40 percent penalty for understated tax tied to undisclosed assets

What If a Client Missed Filing?

The IRS offers Streamlined Filing Compliance Procedures for taxpayers whose noncompliance was non-willful. If eligible, clients can file six years of FBARs and three years of Form 8938 along with a non-willfulness certification.

Common Errors to Watch For

- Filing only one form when both are required

- Misreporting peak balances instead of year-end amounts

- Forgetting that FBAR requires full-value reporting of joint accounts

- Underreporting due to incorrect residency classification

- Excluding foreign-held business shares or pensions from Form 8938

To avoid these pitfalls, some firms turn to SafeBooks’ tax support teams to review documentation and maintain audit trails.

Expert Insight

“TCPA firms should not treat foreign asset disclosure as a routine box-checking task. Every year we see audits triggered by misunderstanding thresholds or failing to report crypto holdings. The rules are clear, but interpretation still requires experience.”

-Shivangi Agrawal

Managing Director (CA, CPA USA), SafeBooks Global

Navigating FBAR and FATCA reporting can be complex, especially with evolving crypto and offshore asset rules. If your firm handles clients with cross-border holdings, SafeBooks Global can help streamline compliance.

Our CPA-trained team supports documentation, filing, and IRS correspondence so you can focus on advisory, not paperwork.

Get in touch with SafeBooks Global to simplify foreign asset reporting.

FAQS

Do I need to file both forms for the same account?

Yes. If both thresholds are met, and the account qualifies under both rules, you must file both forms.

Can I estimate account values?

You must use the highest account balance for FBAR and fair market value at year-end for Form 8938. Use statements as support.

Are foreign crypto wallets included?

In 2025, the best practice is to report foreign-held crypto assets if they exceed $10,000 in total value.

Do jointly held accounts get split?

No. FBAR requires reporting the full account value, even if you only own part of it.

What if my client never filed before?

The IRS Streamlined Procedures allow eligible taxpayers to catch up without full penalties.

-

Director (CA, CPA (USA))

Shivangi is a U.S.-certified CPA and Chartered Accountant with deep expertise in U.S. tax, financial reporting, and audit compliance. She has supported CPA and EA firms across sectors like real estate, SaaS, and healthcare. At SafeBooks, she leads global delivery, ensuring every remote accounting team meets U.S. standards with accuracy, discipline, and client-first execution.