Why Form 1099-DA Is a Structural Shift, Not Just Another IRS Form

Form 1099-DA marks a turning point in digital asset tax enforcement. For the first time, custodial brokers will systematically report digital asset dispositions directly to the IRS, introducing third-party verification similar to traditional securities reporting.

For accounting firms delivering tax support, this is not a routine compliance update. It changes how gains, losses, and documentation risk must be managed.

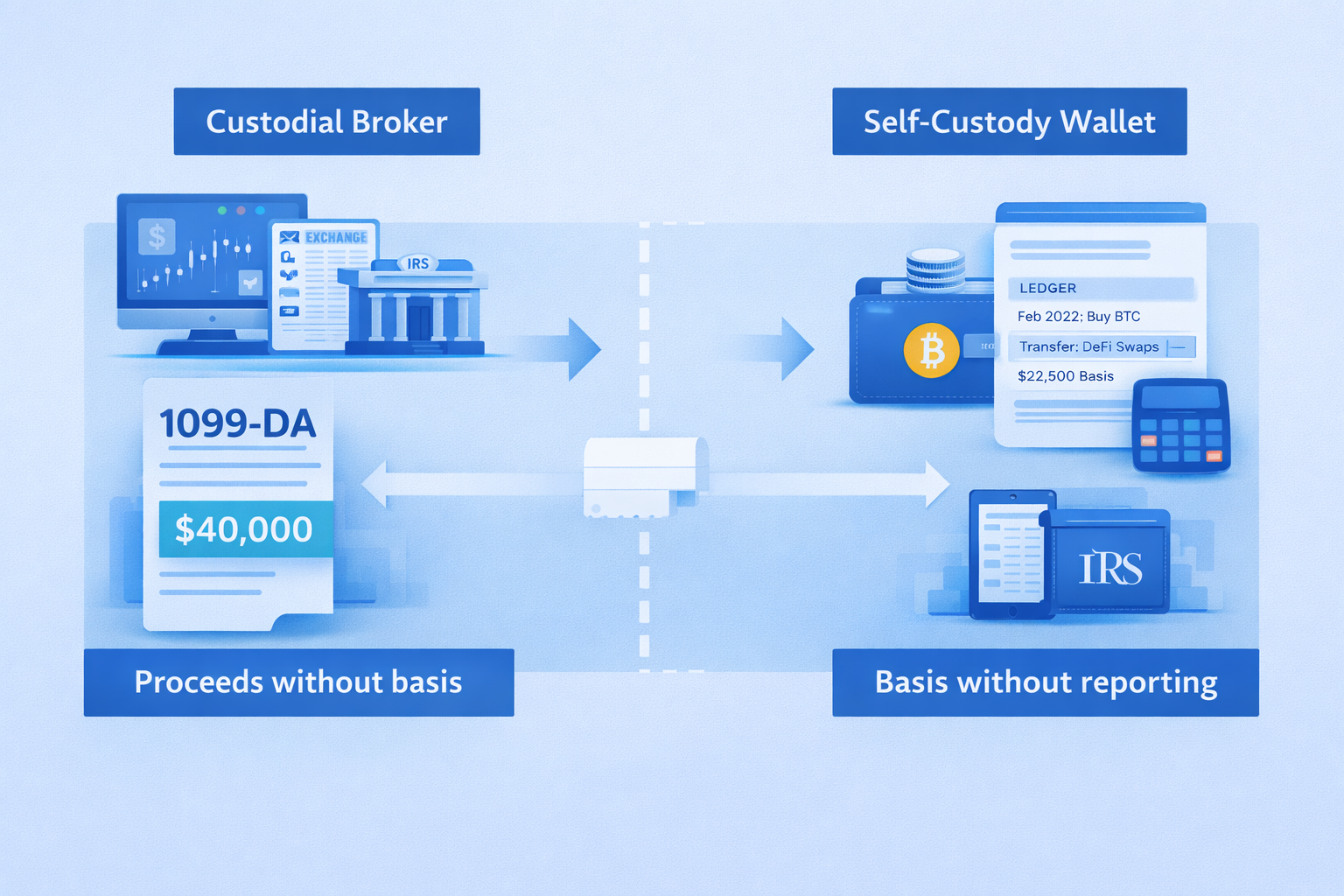

The IRS will now receive broker-reported proceeds even when cost basis is missing or incomplete. This imbalance is what creates the broker vs wallet reconciliation gap.

How Form 1099-DA Reporting Actually Works

Form 1099-DA was introduced under the Infrastructure Investment and Jobs Act to address persistent underreporting of digital asset income. Beginning January 1, 2025, custodial brokers such as centralized exchanges and hosted wallet providers must report qualifying digital asset dispositions.

Reported data typically includes:

- Digital asset identifier and quantity

- Gross proceeds from disposition

- Acquisition date and cost basis for covered assets

- Indicators for noncovered transactions

This information feeds IRS matching systems that compare broker data against Schedule D and Form 8949. For firms providing bookkeeping and accounting support, reconciliation becomes a core compliance task.

The Reporting Timeline That Creates the Risk Window

The phased rollout of Form 1099-DA is a major source of risk.

Form 1099-DA Compliance Timeline

Milestone | Effective Date | Practical Impact |

Gross proceeds reporting | January 1, 2025 | IRS sees realized value |

First broker filings | Early 2026 | Automated matching begins |

Cost basis for covered assets | January 1, 2026 | Limited broker responsibility |

Backup withholding relief | 2025–2027 | Extended transition period |

The IRS has extended backup withholding and certain information reporting penalty relief through 2027 under Notice 2025-33. While this gives brokers more time to build reporting systems, it effectively extends the period during which taxpayers and their advisors must reconstruct cost basis independently, increasing reconciliation pressure.

For firms involved in audit support, this interim phase carries elevated notice and documentation risk.

Why Brokers Cannot Report Accurate Cost Basis

Digital assets rarely remain with a single custodian throughout their lifecycle.

A typical transaction path includes:

- Purchase on one exchange

- Transfer to a self-custody wallet

- DeFi activity or long-term holding

- Transfer to another exchange for liquidation

The final broker sees the inbound transfer and the sale. It typically cannot verify original purchase price, acquisition date, or prior basis adjustments. As a result, many Form 1099-DA filings report gross proceeds without cost basis, even when accurate records exist elsewhere.

This is a structural limitation, not a reporting mistake, and it is the same type of reconciliation risk SafeBooks addresses in its approach to client financial data protection.

Covered vs Noncovered Assets and the Burden Shift

Form 1099-DA applies a covered versus noncovered framework similar to securities reporting, but with tighter constraints.

Covered vs Noncovered Assets Under Form 1099-DA

Attribute | Covered Asset | Noncovered Asset |

Acquisition date | On or after Jan 1, 2026 | Before Jan 1, 2026 |

Custody | Continuous with the same broker | Transferred from wallet or other broker |

Basis reported | Yes | Typically blank or unknown |

IRS assumption | Uses broker basis | Assumes zero unless proven |

When a transaction is marked as noncovered, the broker signals that it cannot verify acquisition history. The burden of substantiating basis shifts to the taxpayer, and that burden often lands on the accounting firm providing back-office support.

The End of Universal Wallet Accounting

Effective January 1, 2025, the IRS eliminated universal accounting for digital assets. Taxpayers can no longer aggregate identical tokens across wallets to select favorable basis.

Accounting must now be performed wallet by wallet or account by account.

Key implications include:

- Basis must follow specific units

- Transfers must be traceable at the unit level

- FIFO or Specific Identification applies within each account

Important Nuance on Specific Identification

For taxpayers choosing Specific Identification instead of FIFO, the IRS requires that the specific lot be identified at or before the time of sale. Retroactive lot selection is not permitted. If this requirement is not met, FIFO may apply by default within that account, potentially changing the tax outcome.

How IRS Matching Converts Data Gaps Into CP2000 Notices

IRS enforcement begins with automated information matching, not audits.

When broker-reported proceeds do not align with Schedule D totals or reported gains, the IRS may issue CP2000 notices proposing additional tax based on zero-basis assumptions for noncovered assets.

A successful response typically requires:

- A reconciled transaction schedule

- Clear acquisition-to-disposition linkage

- Correct use of Form 8949 adjustment codes

Related compliance risk patterns are also covered in SafeBooks guidance on Form 1099 filing and reporting.

Expert Insight

Form 1099-DA is not a tax calculation. It is an information signal. Treating broker data as complete is a critical mistake. The defensible position always comes from reconciling what happened before the asset ever reached the broker.”

— Anshul Agrawal, Accounts Director (CA), SafeBooks

Why Spreadsheet Reconciliation Breaks Down

Manual reconciliation methods struggle under Form 1099-DA because of:

- Multiple brokers issuing independent reports

- Wallet transfers with inconsistent metadata

- DeFi activity altering basis without visible sale events

- Timestamp and timezone discrepancies

Distributed firms managing volume-heavy workflows often run into similar standardization issues described in SafeBooks’ operational content on offshore bookkeeping workflows.

How SafeBooks Closes the Broker vs Wallet Gap

SafeBooks applies continuous financial data governance across brokers, wallets, and internal ledgers.

SafeBooks Capabilities for 1099-DA Reconciliation

Challenge | SafeBooks Approach | Result |

Missing cost basis | Continuous wallet-level tracking | Substantiated basis |

Proceeds mismatch | Cross-system reconciliation | Gains align with IRS data |

Timestamp discrepancies | UTC-to-local time normalization | Correct tax-year alignment |

IRS notices | Structured reconciliation workpapers | Faster resolution |

Audit readiness | Persistent documentation | Reduced enforcement risk |

If your team is building standardized processes for tax and accounting support at scale, SafeBooks also outlines best practices across accounting firm services and broader delivery models for businesses.

Practical Steps Firms Should Take Now

As the 2026 filing season approaches, firms supporting accountants and CPAs should act early.

Recommended actions:

- Identify clients with self-custody wallets or cross-platform transfers

- Perform historical basis reviews

- Move from periodic to continuous reconciliation

- Standardize Form 1099-DA to Form 8949 workflows

- Replace spreadsheets with governed reconciliation systems

For teams staffing and scaling during peak season, SafeBooks also shares operational guidance on remote and offshore workflow setup.

Closing Perspective

Form 1099-DA marks the end of informal crypto tax compliance. It introduces automated enforcement into a fragmented custody environment that was never designed for centralized reporting.

The broker vs wallet reconciliation gap is structural, not accidental.

Firms that treat Form 1099-DA as a reconciliation trigger rather than a final authority will protect clients from overpaying tax and unnecessary IRS scrutiny. Firms that do not will spend future filing seasons responding to avoidable mismatch notices.

SafeBooks helps accounting firms and businesses maintain accurate wallet-level cost basis, reconcile broker-reported proceeds, and build audit-ready documentation under the new digital asset reporting regime.

If you would like to understand how SafeBooks can support your firm or organization with Form 1099-DA reconciliation and digital asset data governance, contact us to speak with our team.

FAQS

Does Form 1099-DA mean the IRS knows my crypto gains exactly

No. The IRS primarily sees gross proceeds. Without proper reconciliation, it may assume zero cost basis for noncovered assets.

Will brokers report cost basis for all crypto transactions

What happens if my broker reports proceeds but no cost basis

How does Specific Identification work under the new rules

How can firms reduce CP2000 notice risk

-

Director (CA)

Anshul is a detail-driven Chartered Accountant who works closely with CPA firms and small businesses to deliver high-impact accounting solutions. With a decade of hands-on experience in U.S. taxation, audits, and workflow optimization, he ensures every client receives consistent, quality-driven support from SafeBooks’ global team.