For CPAs advising foreign-owned businesses in the United States, IRS Form 5472 is not just another checkbox in a compliance workflow. It is a powerful international disclosure tool and one of the most penalty-prone filings in the U.S. tax system. At SafeBooks Global, we have seen Form 5472 missteps lead to six-figure penalties, often for something as basic as an unrecorded capital contribution.

This article explains what triggers the filing requirement, who needs to file, what must be disclosed, and what most CPAs overlook, especially for foreign-owned LLCs.

Why Form 5472 Exists and Why the IRS Cares

Form 5472 is required under IRC Sections 6038A and 6038C. It is used to monitor cross-border transactions between U.S. entities and their foreign owners or affiliates. These transactions often appear in tax avoidance strategies like base erosion or transfer pricing abuse.

Form 5472 does not determine tax due. It is a transparency form. If the IRS suspects noncompliance, this form can become the gateway to a deeper audit before penalties are even considered.

When Form 5472 Is Required

Form 5472 must be filed when any of the following apply:

- A U.S. corporation is at least 25 percent foreign-owned by vote or value

- A foreign corporation is engaged in a U.S. trade or business

- A foreign person owns a U.S. single-member LLC (a disregarded entity)

For example, a Delaware LLC that is 100 percent owned by a nonresident alien must file Form 5472, even if it has no revenue. These entities must file a pro forma Form 1120 with Form 5472 attached.

Understanding Reportable Transactions

The IRS defines reportable transactions broadly. These include:

- Loans, sales, purchases, interest, royalties, and service fees

- Non-cash benefits such as free use of office space

- Capital contributions or distributions

- Reimbursed or shared expenses

- Restructuring, liquidation, or acquisition-related transfers

There is no dollar threshold. A $100 capital injection from a foreign owner counts the same as a $1 million royalty.

Who Is a Related Party?

A related party includes:

- A direct or indirect 25 percent foreign shareholder

- Foreign affiliates or entities under common control

- Family members of owners, per IRC Section 267(b)

- Entities related under IRC Sections 707(b)(1) or 482

Understanding Constructive Ownership Rules

Under IRC Section 318, ownership is not limited to direct holdings. Attribution applies across families and corporate structures. For example, if a foreign company owns 100 percent of Company A, and Company A owns 30 percent of U.S.-based Company B, constructive ownership rules may cause Company B to be considered foreign-owned.

Recordkeeping Requirements Under Section 6038A

IRC Section 6038A(a) requires reporting corporations to maintain records substantiating each transaction’s nature, amount, and purpose. This includes:

- Loan agreements

- Transfer pricing studies

- Invoices or proof of services rendered

- Bank statements or wire confirmations

- Entity ownership documentation

Failure to maintain documentation can result in separate penalties, even if Form 5472 is filed correctly.

What CPAs Frequently Miss

At SafeBooks Global, we help clients resolve issues after they receive IRS notices. Based on this experience, common errors include:

- Not recognizing that foreign-owned LLCs must file, even if dormant

- Ignoring minor or non-cash transactions

- Misapplying constructive ownership rules

- Submitting the form late or unattached to Form 1120

- Using outdated filing methods like fax

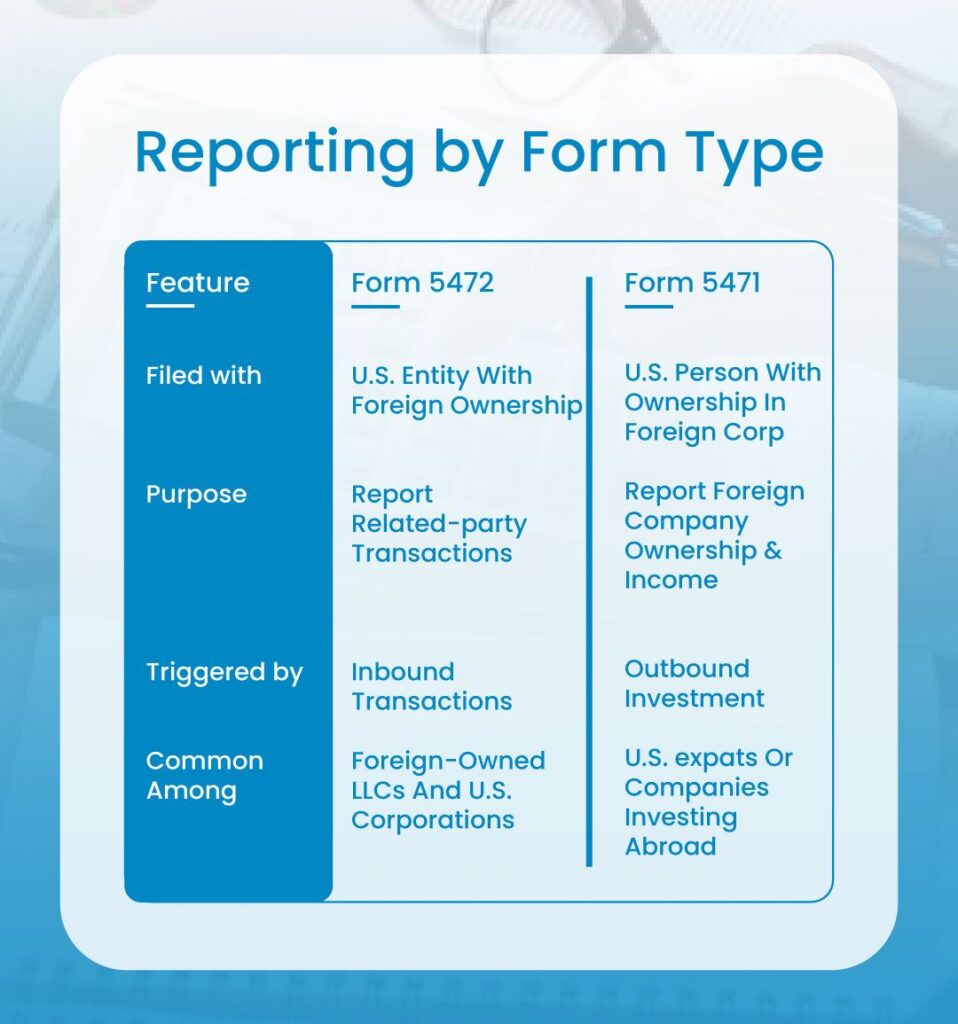

Form 5472 vs. Form 5471

CPAs often confuse Form 5472 with Form 5471. Here is how they differ:

Key Filing Dates and Methods

- April 15: U.S. corporations (calendar-year)

- June 15: Foreign corporations (calendar-year)

- Form 7004: Extends the deadline for both Form 1120 and Form 5472

- Filing Method: Foreign-owned LLCs must file Form 5472 with a pro forma Form 1120 by mail. E-filing is not currently supported for this format.

Penalties and IRS Enforcement

- $25,000 for each missed or incomplete filing

- Additional $25,000 every 30 days after 90-day IRS notice

- Unlimited penalty escalation

- IRS may disallow deductions related to unreported transactions

- Open statute of limitations for years without compliance

Treaty-Based Exemptions and Compliance

If an entity qualifies for an exemption under a U.S. tax treaty, Form 5472 may still be required unless Form 8833 is timely filed. For example, a Canadian company may avoid taxation under the treaty, but if it operates a U.S. LLC with reportable transactions, Form 5472 still applies unless properly disclosed.

Emerging Risks: BOI Reporting and IRS Focus

Starting 2024, FinCEN’s Beneficial Ownership Information (BOI) rules overlap with Form 5472’s ownership disclosures. CPAs must ensure consistency across filings. The IRS has also prioritized Form 5472 enforcement under its LB&I compliance campaigns.

Expert Insight

“Form 5472 is not just an informational filing. It is a compliance signal to the IRS. Many firms overlook capital contributions or minor intercompany transfers, thinking they are insignificant. But even small omissions can trigger hefty penalties or extended audits. Proper interpretation and documentation make all the difference.”

-Shivangi Agrawal

Managing Director (CA, CPA USA), SafeBooks Global

Compliance Starts With Process

To avoid risk:

- Screen foreign ownership during onboarding

- Maintain a year-round ledger of reportable transactions

- Set up a document trail for intercompany arrangements

- File extensions early using Form 7004

- Use professional support for final filings and reviews

Our back office and tax support teams help CPAs stay compliant and protect their clients.

Take Control of This Hidden Compliance Risk

Form 5472 may appear simple but represents a significant compliance obligation. For foreign-owned U.S. entities, especially LLCs, this filing cannot be skipped or treated lightly. CPAs who manage these requirements proactively help clients avoid IRS issues and demonstrate real advisory value.

Looking for support filing Form 5472 or onboarding your foreign clients correctly? Get started with SafeBooks Global.

FAQS

Do all foreign-owned LLCs need to file Form 5472 even if inactive?

Can Form 5472 be filed without an EIN?

Is fax filing still allowed?

How does Form 5472 differ from Form 5471?

What is the best way to avoid penalties?

-

Director (CA, CPA (USA))

Shivangi is a U.S.-certified CPA and Chartered Accountant with deep expertise in U.S. tax, financial reporting, and audit compliance. She has supported CPA and EA firms across sectors like real estate, SaaS, and healthcare. At SafeBooks, she leads global delivery, ensuring every remote accounting team meets U.S. standards with accuracy, discipline, and client-first execution.