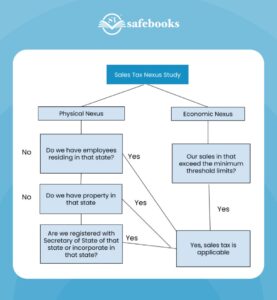

The 2018 South Dakota v. Wayfair decision changed everything about state and local tax (SALT) compliance. Businesses are now responsible for tracking sales and filing taxes across states where they meet “economic nexus” thresholds, even if they have no physical presence.

By 2025, the rules are so complex that manual compliance has become nearly impossible. According to Accounting Today, firms adopting automation save up to 80 percent of the time typically wasted on manual processes (Source). For CPA firms and growing businesses, 2025 is the tipping point: the year to leave manual compliance behind.

The New Reality of Multi-State Compliance

Since Wayfair, 36+ states have adopted economic nexus thresholds. Most require registration once sales exceed $100,000 or 200 transactions annually. Combine that with over 120,000 state and local tax changes each year, and you have a compliance environment that’s impossible to track by hand.

Firms and businesses face mounting challenges:

- Monitoring nexus thresholds across multiple states.

- Registering with different state systems and portals.

- Tracking exemption certificates to avoid errors.

- Managing payroll and tax obligations created by remote employees.

States are enforcing aggressively, and even a small mistake can lead to penalties.

Why Manual Compliance Doesn’t Work Anymore

Manual SALT tracking may have worked in 2019, but today it creates more problems than it solves. Firms relying on spreadsheets face three major challenges:

- Audit exposure: scattered records make it difficult to defend filings.

- Inefficiency: billable hours are consumed by repetitive tasks.

- Scalability issues: what works in three states falls apart in ten or more.

The result is the same for both CPA firms and businesses: more time spent on compliance and less time available for strategy and growth.

How Firms Are Modernizing in 2025

Forward-looking firms are rethinking their compliance approach around two priorities: automation and structure. Instead of relying on spreadsheets and manual reviews, they are moving toward integrated systems that reduce errors and scale with growth.

Here’s what that looks like in practice:

- Automation tools: Platforms like Avalara, Vertex, or TaxJar handle calculations and filings across multiple states.

- Standardized workflows: Firms are building clear processes for exemption certificate management, filing calendars, and audit-ready documentation.

- Specialized partnerships: Some teams work with service providers like SafeBooks, who manage payroll and multi-state tax filings while U.S. staff focus on strategy.

The goal in each case is the same: shifting from reactive filings to proactive compliance. By combining automation with expert oversight, firms can reduce risk, meet deadlines consistently, and create more time for client-facing advisory work.

Expert Insight

“TWayfair shifted the compliance burden in a way no firm can ignore. SALT is now a strategic issue, not just a filing requirement. Firms that continue to rely on manual tracking risk inefficiency, penalties, and even malpractice exposure. 2025 is the year to make automation and structured support part of your model.”

– Shivangi Agrawal

Managing Director (CA, CPA USA), SafeBooks Global

Building a Smarter Compliance Model

Adapting to the post-Wayfair environment doesn’t mean losing control it means creating a system that scales with your clients.

The roadmap often includes:

- Reviewing existing state exposure.

- Integrating compliance tools into your existing stack.

- Setting up audit-ready workflows.

- Partnering with specialized teams who monitor updates and ensure filings happen on time.

The outcome: reduced risk, fewer penalties, and more time to focus on advisory work.

Why Now Is the Time to Act

By 2025, manual SALT compliance is not only inefficient, it is risky. States are stepping up enforcement, clients expect proactive guidance, and the sheer volume of changes makes manual tracking unsustainable.

Making the move now to structured compliance, whether through automation, specialized support, or both, reduces penalties and creates room for firms to focus on higher-value services. Book a consultation with SafeBooks to discuss how your firm can build a compliance model that scales.

FAQS

What is SALT compliance after Wayfair?

It means meeting sales and use tax requirements across states where your business has economic nexus, not just physical presence.

Why is 2025 such a turning point?

Because enforcement is increasing, and manual processes can’t keep up with the pace of tax law changes.

How does SafeBooks help with compliance?

We handle multi-state registrations, filings, exemption certificates, and nexus monitoring, while working inside your accounting stack.

Is outsourcing compliance secure?

Yes. SafeBooks provides secure, audit-ready documentation with role-based access for transparency.

Can SafeBooks work alongside automation platforms?

Absolutely. We complement tools like Avalara or Vertex by ensuring filings are accurate, deadlines are met, and compliance is continuous.

-

Director (CA, CPA (USA))

Shivangi is a U.S.-certified CPA and Chartered Accountant with deep expertise in U.S. tax, financial reporting, and audit compliance. She has supported CPA and EA firms across sectors like real estate, SaaS, and healthcare. At SafeBooks, she leads global delivery, ensuring every remote accounting team meets U.S. standards with accuracy, discipline, and client-first execution.