Running a business means dealing with more than just sales and customers. Behind the scenes, accounting rules can affect how much tax you pay and when you pay it. One rule that often confuses business owners is the 12-month rule for prepaid expenses.

This rule is especially relevant for small to mid-sized businesses in the U.S., many of which rely on outsourced accounting support to stay compliant. In this blog, we’ll break down what the 12-month rule means, how it works, and why outsourcing prepaid expense management can save you time, money, and stress.

First, What Exactly Is a Prepaid Expense?

Think of prepaid expenses as payments made today for a benefit you’ll enjoy in the future. Common examples include:

- Insurance premiums

- Rent paid in advance

- Subscriptions and service contracts

- Annual software licenses

Because these payments stretch into the future, the IRS treats them differently from regular expenses.

The 12-Month Rule Made Simple

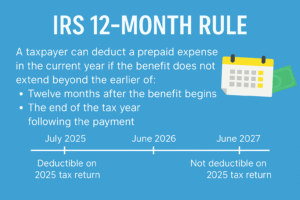

Here’s the IRS shortcut: you can deduct certain prepaid expenses immediately if the benefit does not go beyond the earlier of:

Example in Action:

Pay a 12-month insurance premium in July 2025 (coverage through June 2026), and you can deduct it in 2025.

Prepay rent for two years, and you’ll only deduct the portion that qualifies. The rest has to be spread over time.

Other Common Scenarios:

- Prepaid Rent (2 years): If you pay two years’ rent upfront, only the first 12 months qualify under the rule. The rest must be spread across the second year.

- Annual Software License: A license purchased in December 2025 for January–December 2026 can be deducted in 2025, since it fits the 12-month window.

- Subscription Paid in Advance: Paying for a 6-month service subscription starting April 2025 is fully deductible in 2025, as it ends within the same tax year.

This helps businesses avoid tracking every small prepaid expense across multiple years.

Remember that under certain situations, the 12-month rule does not apply for capitalizing prepaid expenses. You can write out the expense if the following conditions are met:

- Salaries or wages

- Insignificant amount (less than $1,000)

- Personal prepaid expenses

- Amounts connected with payment of policies and plans

What About Accrual Accounting?

If your business uses accrual accounting, you normally record expenses when they’re incurred, not when cash leaves your account. The 12-month rule makes an exception.

Example:

- You pay $24,000 in December 2025 for office rent covering January–December 2026.

- Accrual rules would spread $2,000 per month across 2026.

- With the 12-month rule, you can deduct the full $24,000 in 2025.

It’s a useful simplification, but you need consistency and documentation to support it.

Expert Insight

“The 12-month rule is simple in theory, but small businesses often misapply it because of complex contracts or inconsistent documentation. Having a reliable process and expert oversight makes the difference between smooth compliance and year-end stress.”

– Shivangi Agrawal

Managing Director (CA, CPA USA), SafeBooks Global

Why Businesses Slip Up With Prepaid Expenses

Even with a clear rule, mistakes can still occur. Common issues include:

- Amortization errors occur when schedules are tracked manually

- Contracts that extend too far, making it tricky to decide what qualifies

- Lost deductions from the misapplication of the rule

- Overworked in-house teams who don’t have time to double-check details

That’s where a partner like SafeBooks can help. Our remote accounting workflows are designed to prevent these errors and ensure accurate reporting.

How Outsourcing Brings Relief

Outsourcing prepaid expense management does more than just save time. It helps in two critical ways:

- Accuracy powered by technology: Cloud platforms automate prepaid tracking, flag compliance deadlines, and reduce manual errors.

- Bookkeeping team powered with tax knowledge: Experienced accountants review your records with IRS and GAAP expertise. This ensures prepaid expenses are classified correctly and deductions are maximized. It also gives you peace of mind during audits.

To explore how to choose the right offshore partner, see our guide on evaluating offshore accounting teams.

Details Many Businesses Overlook

While most content stops at explaining the rule, here are a few angles SafeBooks clients often ask about:

- SaaS firms dealing with prepaid servers versus nonprofits managing prepaid grants

- Cross-border workflows where U.S. firms rely on India-based accounting teams

- Transition challenges when moving prepaid tasks from in-house staff to a remote team

Addressing these details ensures prepaid expense management becomes a growth tool, not just a compliance task.

What’s Changing in Prepaid Expense Management

- AI and automation are cutting down repetitive amortization work

- Offshore teams allow updates to happen overnight, speeding reporting cycles

- Data security is now a non-negotiable, with SOC 2 and ISO certifications front and center

- Cash flow planning is increasingly tied to prepaid expense strategy

You can read more about how SafeBooks prioritizes client data security as part of this shift.

Bringing It All Together

The 12-month rule is meant to make life easier, but only if you apply it correctly. For many U.S. businesses, it’s not the rule itself but the day-to-day execution—tracking, classifying, and documenting that creates stress.

That’s where SafeBooks comes in. By combining IRS expertise with dedicated offshore teams, we help you manage prepaid expenses without adding to your in-house workload. If you want accuracy, compliance, and more time to focus on growing your business, get in touch with us today.

FAQS

What is the 12-month rule in simple terms?

It lets you deduct prepaid expenses immediately if the benefit doesn’t extend beyond 12 months or the next tax year.

Do all prepaid expenses qualify under the rule?

No. Longer-term prepayments need to be spread out over time.

How does the rule apply to accrual accounting?

Even under accrual, qualifying prepaid expenses can be deducted right away. Documentation is key.

Does the rule apply to rent and insurance?

Yes, if the prepayment fits within the 12-month limit.

What happens if prepaid expenses are misapplied?

You could lose deductions or face audit issues. Outsourced teams like SafeBooks help prevent that.

-

Director (CA, CPA (USA))

Shivangi is a U.S.-certified CPA and Chartered Accountant with deep expertise in U.S. tax, financial reporting, and audit compliance. She has supported CPA and EA firms across sectors like real estate, SaaS, and healthcare. At SafeBooks, she leads global delivery, ensuring every remote accounting team meets U.S. standards with accuracy, discipline, and client-first execution.