When the IRS released Revenue Procedure 2025-32 in October 2025 it did more than publish another set of inflation tables. It translated the One Big Beautiful Bill Act (OBBBA) into concrete numbers for the 2026 tax year.

At a high level, OBBBA:

- Made most of the key individual provisions from the Tax Cuts and Jobs Act effectively permanent

- Locked in higher standard deduction amounts

- Extended and refined the Section 199A qualified business income (QBI) deduction

- Adjusted child, earned income and adoption related credits

- Added new reporting and administrative requirements across several areas

Revenue Procedure 2025-32 is the technical mechanism that now:

- Updates federal tax brackets for 2026

- Sets standard deduction and credit amounts

- Raises limits for Section 179 expensing and other business provisions

For US accounting firms that already rely on remote and offshore teams, these changes matter directly. They influence:

- W4 withholding changes for 2026 remote workers

- The after tax value of salary bands across states

- QBI planning for partner led firms

- Technology and staffing investment decisions

This guide focuses on those decision points and connects them to how SafeBooks clients actually run their practices. For more background on offshore models and tax law shifts, you can also review:

- Why more US accounting firms are outsourcing tax preparation in 2025

- Inside the rise of offshore CPA firms in the US market

- One Big Beautiful Bill tax update

Standard deduction changes and what they do to remote paychecks

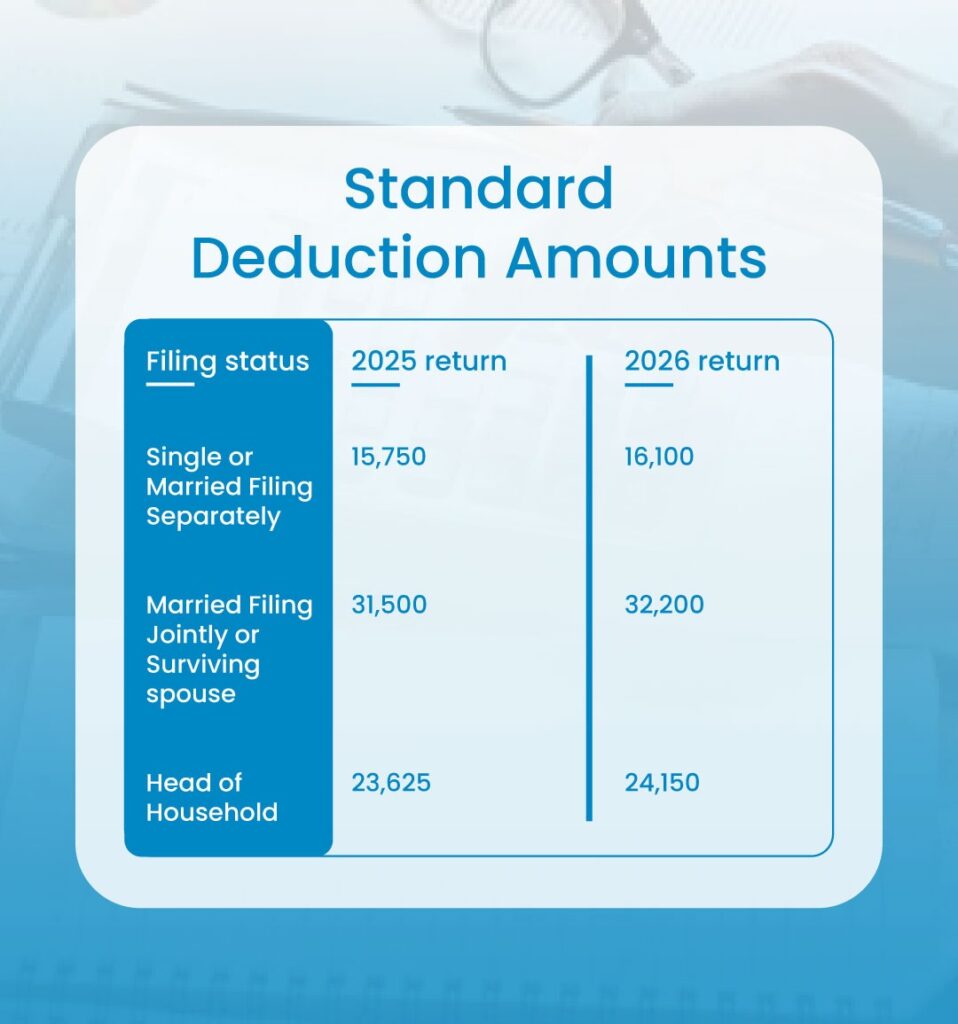

OBBBA increased the standard deduction starting in 2025 and Revenue Procedure 2025-32 pushes the figures higher again for 2026.

These higher amounts mean a larger slice of income is not taxed at all. For many employees the standard deduction will continue to beat itemizing, even in higher tax states.

Quick take home pay example

Consider a remote staff accountant who is:

- Single

- Earning $80,000

- Claiming the standard deduction

Ignoring credits and state tax, the taxable income portion of their pay falls by $350 between 2025 and 2026 as the standard deduction rises from 15,750 to 16,100. At a marginal rate of 22 percent this alone trims almost $80 from federal tax due. The effect is modest but real, and it stacks with bracket adjustments discussed next.

For a firm with a large remote workforce this adds up across the team and will show up as small but noticeable shifts in net pay once 2026 withholding tables are in place.

W4 withholding changes for 2026 remote workers

Because the standard deduction is baked into the IRS withholding formula, payroll must be recalibrated. Good practice for 2026 is to:

- Confirm your payroll provider has imported the 2026 Publication 15-T tables

- Invite employees, especially those with multiple jobs, to revisit their W4 using the IRS estimator

- Document how withholding assumptions change for cross border or multi state staff

If your firm is already using SafeBooks for payroll and sales tax filing, these W4 and standard deduction updates can be folded into your normal year end payroll checklist.

Updated 2026 tax brackets and the real effect on distributed staff

Revenue Procedure 2025-32 keeps the seven familiar federal rates but shifts thresholds upwards, roughly in line with inflation. That keeps cost of living raises from pulling staff into higher brackets without genuine gains in purchasing power.

For example, in 2026 for Married Filing Jointly, the brackets are:

- 10 percent on taxable income up to 24,800

- 12 percent on 24,800 to 100,800

- 22 percent on 100,800 to 211,400

- 24 percent on 211,400 to 403,550

- 32 percent on 403,550 to 512,450

- 35 percent on 512,450 to 768,700

- 37 percent above 768,700

Paired with higher standard deductions, this means many staff will stay in familiar brackets even if their gross pay rises by several thousand dollars.

Example for remote team planning

Imagine two senior remote reviewers, both married and filing jointly.

- Reviewer A earns 190,000 in 2025

- Reviewer B earns 205,000 in 2026 after a raise

Under older brackets, Reviewer B might have drifted deeper into the 24 percent band with no change in real purchasing power. Under the 2026 thresholds, the combination of:

- Higher bracket cutoffs

- Higher standard deduction

keeps the effective tax rate closer to that of Reviewer A, even after the raise. When you map salary bands for remote staff in different states, this helps preserve after tax parity.

SafeBooks often builds these after tax comparisons into planning sessions for firms using our bookkeeping and accounting support, especially when clients are hiring in both high tax and low tax states.

Credits and deductions that remote teams should not ignore

Revenue Procedure 2025-32 also updates several credits and deductions that are directly relevant to how remote and offshore teams live and work.

EITC and part time or entry level remote staff

For 2026, the Earned Income Tax Credit (EITC) maximum for three or more qualifying children rises to $8,231, with lower maximums for smaller families. More importantly, phaseout thresholds also rise.

For example:

- For married filing jointly, phaseout now runs from roughly 18,000 to more than 70,000 of income depending on number of children

- For other filing statuses, phaseout bands generally start above 10,000 and extend into the low 60,000 dollar range

- The associated investment income limit for EITC eligibility is now above $12,000

Why this matters for remote teams:

- Seasonal and part time staff who support tax season may qualify in some years and not others

- Entry level team members in lower cost locations may sit right inside the new phaseout bands

- Correct withholding and good communication can prevent unpleasant surprises at filing time

If your firm relies heavily on remote junior staff, you can fold EITC awareness into your year end payroll communication templates, alongside other updates like Form 1099 reporting.

Child related credits and adoption benefits

OBBBA and Revenue Procedure 2025-32 preserve and gently raise the value of:

- The per child tax credit, including its refundable portion

- Adoption credits and exclusions, especially for special needs adoptions

For your team members this affects family budgets more than firm level planning, but it is worth knowing which employees may benefit so that HR can direct them toward qualified tax advisers.

QBI deduction for accounting firms after 2025-32

For firm owners, the Section 199A QBI deduction is often the single largest moving part in the entire procedure.

Key features after OBBBA and Revenue Procedure 2025-32:

- The 20 percent QBI deduction for pass through income is now a permanent part of the landscape

- Income thresholds for specified service trades such as accounting are raised for 2026, allowing more full deductions

- A new minimum QBI amount and minimum deduction floor apply from 2026 onward

A simple example:

- A remote first accounting firm organised as an S corporation earns $200,000 of qualified business income in 2026

- If the owners fall below the specified service thresholds, they can deduct $40,000 from taxable income under QBI alone

That deduction stacks with Section 179 expensing and other ordinary business deductions.

SafeBooks supports this type of planning both through day to day back office support and through focused tax support engagements.

Section 179 expensing for cloud accounting software and equipment

Revenue Procedure 2025-32 raises Section 179 expensing limits again for 2026, with:

- A maximum deduction in the mid 2.5 million dollar range

- A higher phaseout threshold that begins once total qualifying purchases exceed roughly 4.1 million dollars

For remote and offshore heavy accounting firms, typical Section 179 candidates include:

- Laptops, headsets and ergonomic setups for new offshore hires

- Practice management and workflow software licences

- On premise servers for firms that mix cloud and local hosting

Section 179 lets you expense these costs immediately rather than over years. When aligned with QBI planning, it gives you real flexibility over how much profit you show in any given year. For ideas on where technology investment fits into the bigger picture you can also see our guide on the best tech stack for offshore accounting firms.

Multi state payroll, remote work and cross border reality

Federal brackets and deductions only tell half the story for remote staff. The other half is state and cross border compliance.

Multi state payroll tax for remote staff

In general:

- State income tax is based on where the work is physically performed

- Employers must often register for payroll and unemployment accounts in any state where employees are based

- Some states apply strict convenience of the employer rules that can tax out of state workers as if they remained in the original office state

This creates common failure points:

- Remote employees move and forget to inform HR promptly

- Payroll systems keep withholding for the old state

- Reciprocal agreements between neighbouring states are misunderstood or ignored

SafeBooks covers state and local complexity in more depth in 2025 SALT compliance after Wayfair. For remote teams those same principles apply with even more force because physical presence is now scattered instead of centralised.

Offshore compliance for teams in India and other jurisdictions

Offshore staff in India, the Philippines or other countries are not subject to US federal brackets on their own wages. However, their presence still creates important planning questions for the US firm, including:

- How you structure the relationship

- Direct employment through a local entity

- Engagement through a professional employer organisation

- Contracting with an independent offshore service provider

- How you book the cost

- Wages and payroll taxes if you employ locally

- Contract service fees if you engage through a provider

- Transfer pricing considerations if you control both entities

- Where permanent establishment risk sits

- Whether your offshore presence rises to the level of a taxable branch in that country

- How tax treaties and local law define that threshold

For example, a US accounting firm that opens its own subsidiary in India must align:

- Local payroll and social security contributions

- Indian income tax withholding for staff

- Intercompany pricing on services performed for the US parent

Ignoring these questions can undo much of the benefit created by QBI and Section 179 at home.

SafeBooks itself operates as an offshore delivery partner for US firms and is structured to keep these questions clear. Our About Us and Accounting Firms pages explain how we integrate with client systems while respecting both US and local rules.

Five concrete moves firms can make before 2026 payroll goes live

To turn Revenue Procedure 2025-32 into operational advantages, firm leaders can follow a clear sequence.

- Refresh payroll and W4 logic across the entire remote team

- Verify that 2026 federal and state tables are active in your core payroll system

- Invite staff to revisit W4 entries, especially anyone with multiple jobs or major 1099 income

- Rebuild net pay models for key locations

- Use simple salary bands such as 60,000, 90,000 and 120,000 and calculate expected federal tax in both 2025 and 2026

- Overlay state tax differences to understand after tax pay for remote roles in different regions

- Map QBI and Section 179 planning for owners

- Estimate 2026 profit and QBI exposure

- Identify technology or equipment investments you plan to make and decide whether to expense or depreciate

- Tighten multi state and cross border tracking processes

- Confirm you know where each remote employee physically works

- Put in place a simple internal form that employees use to report moves before they happen

- Communicate clearly with staff about what is changing and why

- Prepare a short internal memo summarising brackets, standard deductions and who might see a change in net pay

Encourage staff to consult their own advisers rather than giving individual tax advice in house

Clients who use SafeBooks for audit support and sales tax support often fold these steps into their year end close process so that financial statements and payroll assumptions are aligned.

Questions firms are asking about Revenue Procedure 2025-32

1. Is every employee required to file a new W4 for the 2026 tax year?

No. The IRS does not require a new W4 each year. However, it is sensible to encourage updates when there are major rule changes or life events. For remote teams this is especially true for staff who:

- Work more than one job

- Have significant freelance or gig income alongside their main role

- Married or divorced in the last year

- Added or lost dependents

Your role as the employer is to apply correct 2026 tables and to make it easy for staff to submit updated forms when needed.

2. How does Revenue Procedure 2025-32 change planning for remote contractors who might become employees?

The procedure changes the numbers involved rather than the classification rules themselves. When you compare contractor and employee paths, you now need to model:

- Different treatment of home office and other unreimbursed expenses

- Different timing of tax payments, with employees relying on withholding and contractors on quarterly estimates

- The effect of QBI on owner level profit when you bring key contractors inside the entity and pay them as W2 staff

- Credit eligibility for the individuals, including EITC and child related credits, which can shift when income moves from Schedule C to wages

A structured side by side comparison for each major role is better than a one size decision. Many firms end up with a blended model in which core roles are employees and highly specialised or short term roles remain contractor based.

3. Do the new rules change home office deductions for W2 remote employees?

Federal rules for home office deductions remain largely unchanged. Most W2 employees cannot claim unreimbursed employee business expenses on their federal returns, even if their employer requires remote work. Some states have different rules or require employers to reimburse certain costs.

Self employed individuals and independent contractors can still choose between:

- A simplified home office method calculated per square foot

- A regular method based on actual expense allocation

This difference is one of several factors to consider when designing remote role structures.

4. Are offshore team members ever directly affected by Revenue Procedure 2025-32?

Offshore staff paid under local law are generally not subject to US federal income tax on their wages unless they also qualify as US tax residents. Revenue Procedure 2025-32 affects them indirectly through:

- How their cost flows into your US taxable profit

- The pace at which you expense technology and infrastructure that supports them

- The profit margin that ultimately flows to US owners and is subject to QBI rules

You still need to manage local payroll, social security and labour law in each country where you have staff or service providers.

Expert Insight

Question

What single move gives an accounting firm the most leverage from Revenue Procedure 2025-32 if it already has remote and offshore teams in place?

Answer from Bindesh Jain, Tax Director (CA, CS)

“Treat 2025-32 as a chance to reset your architecture, not just your numbers. Start by lining up your entity structure, QBI position and Section 179 plans with the way your remote and offshore teams actually operate. Once that alignment is in place, payroll tables, W4 updates and multi state registrations become execution details instead of annual emergencies. Firms that invest in this alignment once tend to enjoy smoother busy seasons for years after.”

If your internal team does not have capacity to lead that reset, SafeBooks can act as a remote partner for the planning and execution phases. You can learn how we typically engage with firms on the Get Started page or by reaching out through Contact Us.

Key takeaways for firm owners planning the 2026 season

Revenue Procedure 2025-32 and the One Big Beautiful Bill Act together define the tax environment your remote and offshore accounting teams will operate in for the next several years. The headline items are:

- Higher standard deductions and adjusted brackets that reshape take home pay

- Stronger, more stable QBI and Section 179 frameworks for pass through entities

- Updated credits and multi state considerations that directly affect staff experience and compliance risk

SafeBooks Global was built to help firms manage exactly these intersections of tax law, technology and remote delivery. Our leadership, including Anshul Agrawal and Bindesh Jain, has focused on combining reliability, compliance and modern tools for firms that want offshore support without losing control. You can read more about that mission on the here and in our growing blog library.

The firms that win the next few busy seasons will not be the ones that memorise every number in Revenue Procedure 2025-32. They will be the ones that translate those numbers into clean systems, clear communication and confident planning for their remote and offshore teams.

-

Director (CA, CS)

A Chartered Accountant and Company Secretary with over 11 years of experience, Bindesh specializes in direct taxation, estate planning, and statutory compliance. He helps U.S.-focused firms navigate complex tax issues with precision and foresight, while ensuring every SafeBooks engagement meets legal and procedural expectations.