The Manufacturer’s Windfall

Qualified Production Property and 100 Percent Expensing Under Section 168(n)

Why Section 168(n) Changes Manufacturing Economics

The One Big Beautiful Bill Act (OBBBA), enacted in July 2025, introduced one of the most consequential manufacturing incentives in modern tax history: Internal Revenue Code Section 168(n).

For the first time, manufacturers can fully expense qualifying production real estate in the year it is placed in service. Historically, factories and industrial facilities were depreciated over 39 years under straight-line MACRS. Section 168(n) collapses that recovery period into year-one expensing, materially altering the economics of domestic manufacturing investment.

This is not bonus depreciation.

This is not cost segregation.

It is a new statutory framework designed to reduce capital friction and accelerate reshoring.

What Is Qualified Production Property

Qualified Production Property (QPP) is defined as nonresidential real property used by the taxpayer as an integral part of a qualified production activity conducted within the United States.

To qualify, all of the following must be true:

- The property is nonresidential real property

- The property is located in the US or its possessions

- The taxpayer owns and operates the facility

- The property is used in a qualified production activity

- A valid election is made on a timely filed return

Unlike bonus depreciation, QPP does not apply automatically.

The Owner-Operator Requirement

Section 168(n) imposes a strict owner-occupant rule.

The taxpayer that:

- Owns the real property must also

- Conduct the qualified production activity

Leased facilities do not qualify.

This disqualifies many common structures where real estate is held in a separate LLC and leased to an operating company. Unless restructured, these arrangements lose the QPP benefit entirely. This issue frequently arises during tax planning engagements for accounting firms supporting manufacturing clients.

Qualified Production Activities and the Substantial Transformation Test

The QPP deduction depends on whether the facility is used in a qualified production activity, which includes manufacturing, refining, agricultural production, or chemical production.

The controlling standard is substantial transformation.

What Qualifies as Substantial Transformation

A process must materially change raw materials into a product with a new character, use, or identity.

Industry | Qualifying Activity |

Metals | Converting raw steel into finished components |

Chemicals | Refining or synthesis |

Food | Processing raw inputs into consumables |

Electronics | Manufacturing battery cells or circuit boards |

Advanced manufacturing | Semiconductor or turbine component fabrication |

What Does Not Qualify

Activity | Reason |

Packaging only | No material transformation |

Warehousing | Post-production |

Distribution | No production |

Minor assembly | Insufficient change |

Showrooms | Sales activity |

R&D labs | Governed by Section 174 |

This distinction often determines whether millions in deductions are allowed or denied.

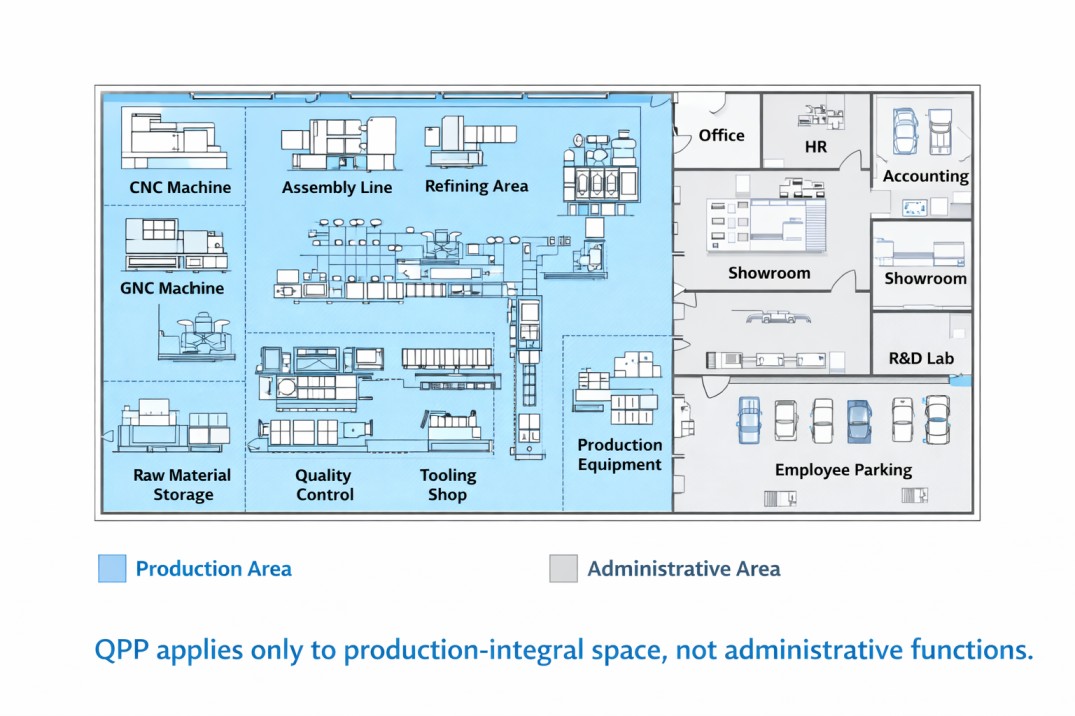

The Functional Geography of a Factory

Section 168(n) does not apply to an entire facility by default. Only the portion of the building that is integral to production qualifies.

Eligible areas commonly include:

- Production floors

- Process control rooms

- Quality testing zones

- Equipment support areas

Excluded areas include:

- Administrative offices

- HR and finance departments

- Sales and marketing space

- Cafeterias and parking

Why Cost Segregation Is Now a Compliance Requirement

Cost segregation under Section 168(n) is no longer optional. It is required to:

- Allocate building costs between QPP-eligible and non-eligible areas

- Support square-footage or engineering-based allocations

- Create audit-ready documentation

The Three-Bucket Allocation

Asset Category | Tax Treatment |

Machinery and equipment | 100% bonus depreciation |

Land improvements | 100% bonus depreciation |

Building shell | Split between QPP and 39-year MACRS |

Engineering-based studies are critical and frequently reviewed during audit support engagements.

Timing Windows and the 10 Percent Safe Harbor

QPP eligibility is subject to strict timing requirements:

- Construction must begin after January 19, 2025

- Construction must begin before January 1, 2029

- Property must be placed in service before January 1, 2031

The 10 Percent Safe Harbor Rule

Construction is deemed to have begun once the taxpayer has incurred at least 10 percent of the total project cost, excluding land acquisition, design fees, and financing costs. Failure to properly document this threshold can disqualify the entire QPP deduction.

Used Property Exception and Look-Back Requirement

An existing facility may qualify as QPP if it meets the used property exception.

To qualify:

- The facility must not have been used in a qualified production activity at any time between January 1, 2021, and May 12, 2025

This creates a substantial documentation burden for buyers, who must obtain representations and supporting evidence from prior owners to establish non-production use during the look-back period.

The 10-Year Recapture Commitment

Section 168(n) includes a ten-year recapture rule.

If, within ten years of being placed in service, the property:

- Is sold to a non-manufacturer

- Is converted to warehousing or office use

- Ceases qualified production activity

Then the previously claimed deduction is recaptured as ordinary income in the year of change. This rule effectively requires a decade-long commitment to domestic production.

Expert Insight

“Qualified Production Property is one of the most powerful manufacturing incentives ever enacted, but it is also one of the easiest to misapply. The production versus admin split, timing rules, and ten-year recapture requirement make documentation and planning essential from day one.”

Bindesh Jain, Tax Director (CA, CS), SafeBooks

State Conformity and Site-Selection Risk

Federal QPP benefits do not automatically flow through to state returns.

Several states have already decoupled, including:

- California

- Rhode Island

- Delaware

- Michigan

- Pennsylvania

In these jurisdictions, manufacturers may receive a 100 percent federal deduction while continuing to depreciate the building over 39 years at the state level. This divergence creates deferred tax assets and materially affects site-selection modeling for new facilities.

Why This Matters for Manufacturing Leaders

Section 168(n) is not a simple tax incentive. It directly influences:

- Facility design

- Entity structuring

- M&A decisions

- Long-term operational strategy

SafeBooks supports manufacturers and accounting firms with QPP modeling, cost segregation coordination, and audit-ready documentation frameworks.

To discuss how SafeBooks can support Qualified Production Property planning and compliance, contact us.

FAQS

Does the entire factory qualify for QPP

Can leased manufacturing facilities claim QPP

Is the QPP deduction automatic

What triggers QPP recapture

Can an existing facility qualify as QPP

-

Director (CA, CS)

A Chartered Accountant and Company Secretary with over 11 years of experience, Bindesh specializes in direct taxation, estate planning, and statutory compliance. He helps U.S.-focused firms navigate complex tax issues with precision and foresight, while ensuring every SafeBooks engagement meets legal and procedural expectations.