The Offshore Performance Problem Hiding in Plain Sight

Offshore teams rarely fail because of lack of technical skill.

They fail because questions are not asked early, risks are not surfaced on time, and errors are disclosed only when deadlines are already compromised. This pattern appears repeatedly across offshore software, accounting, audit, tax, and compliance teams.

Western managers often diagnose this as a performance or accountability issue. In reality, it is a socio-technical failure rooted in psychological safety and cultural friction.

While tools, SOPs, and training programs address visible gaps, they do not fix the invisible hesitation that prevents offshore professionals from speaking up when it matters most. This is why firms that work with capable offshore teams through partners such as SafeBooks Global still experience avoidable delays, rework, and late-stage escalations.

Why Traditional Offshore Management Models Break Down

Most offshore delivery models assume that clarity equals compliance.

Clear instructions, detailed workflows, and task trackers are expected to produce predictable outcomes. This assumption ignores how cultural norms shape behavior under uncertainty.

In high-power-distance cultures such as India, authority is respected, hierarchy is rarely challenged, and questioning a superior can feel personally risky rather than professionally responsible.

When offshore professionals encounter ambiguity, they often choose silence over clarification. Not because they do not care, but because asking questions can feel like exposing incompetence or disrespecting authority.

This creates what many leaders mislabel as a “yes culture,” where agreement signals acknowledgment, not feasibility.

Psychological Safety as a Measurable Performance Driver

Psychological safety is often described as a soft concept. In offshore delivery, it is a hard operational variable.

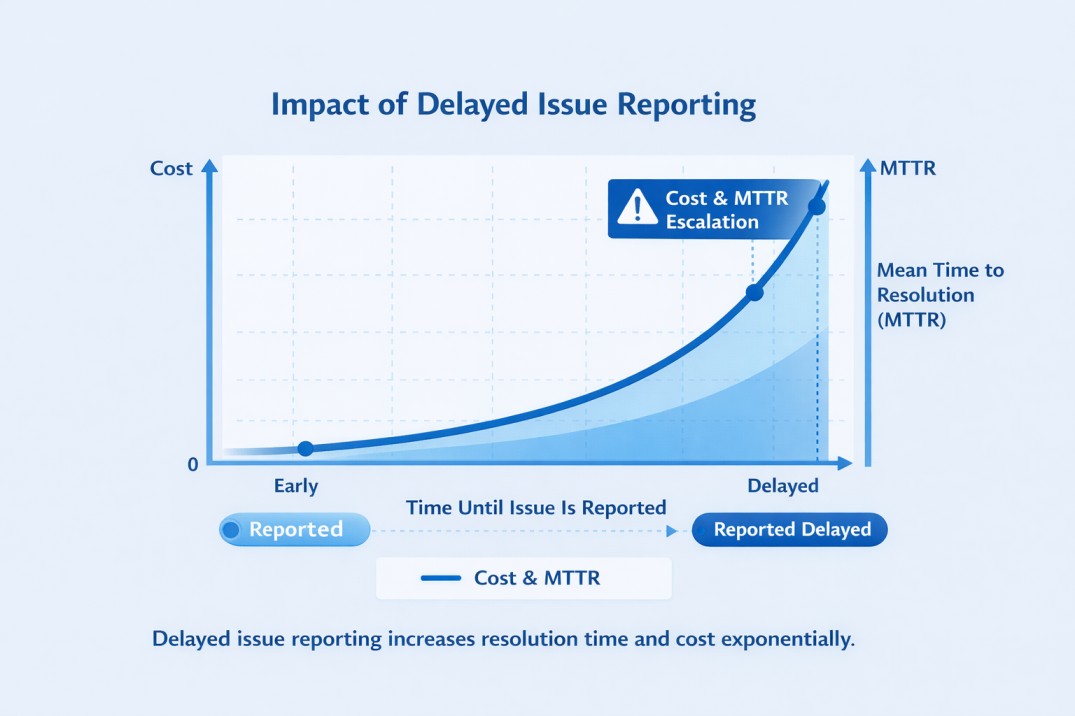

Teams that feel safe to raise concerns surface issues earlier. Teams that do not feel safe delay disclosure. That delay shows up directly in delivery metrics.

When psychological safety is low:

- Mean Time to Resolution (MTTR) increases because issues are discovered late

- Defect Density rises because mistakes compound before review

- Cycle Time volatility increases due to last-minute corrections

When psychological safety is high:

- MTTR decreases because issues are flagged at first detection

- Defect density drops due to early clarification and peer review

- Delivery timelines stabilize because risks are addressed upstream

These are not cultural side effects. They are measurable outcomes.

The Four Stages of Psychological Safety in Offshore Teams

Stage | Practical Expression | Metric Impact When Missing |

Inclusion Safety | Offshore members feel respected and heard | Low participation, delayed clarifications |

Learner Safety | Freedom to ask questions and admit gaps | Higher defect density |

Contributor Safety | Confidence to apply judgment independently | Mechanical task execution |

Challenger Safety | Ability to question assumptions and timelines | Late-stage escalations, MTTR spikes |

Most offshore teams reach learner safety at best. Challenger safety, the stage that prevents delivery failure, is rarely achieved without deliberate structural intervention.

Cultural Friction and Power Distance in Offshore Delivery

India’s Power Distance Index is significantly higher than that of most Western countries. Hierarchy is normalized. Deference is expected. Challenging authority is avoided.

In offshore accounting and audit environments, this leads to:

- Unrealistic timelines being accepted without objection

- Partial understanding of requirements going unclarified

- Risks being internally recognized but externally unreported

From a delivery perspective, this creates a false sense of progress until issues surface too late to correct cleanly.

The Face-Saving Effect and the Cost of Silence

In high-context cultures, preserving personal and group reputation carries significant weight. Reporting problems can feel like a personal failure rather than a professional responsibility.

This produces the “mum effect,” where bad news is delayed to avoid discomfort or loss of standing.

From a cost perspective, delayed disclosure is devastating. The longer an issue remains unspoken, the more downstream dependencies it affects.

The Buddy System as a Structural Fix

Documentation does not reduce hesitation. Safe human connection does.

A structured buddy system pairs offshore team members with experienced peers outside their reporting line. This creates a low-risk channel for questions that prevent downstream errors.

How an Effective Buddy System Works

Phase | Focus | Safety Outcome |

First 30 Days | Tools, norms, communication patterns | Inclusion safety |

Days 31–60 | Standards, expectations, review logic | Learner safety |

Days 61–90 | Shared ownership and delivery decisions | Contributor safety |

Teams that implement buddy systems consistently see faster onboarding, lower MTTR, and fewer late-stage corrections.

Feedback Loops That Actually Build Trust

Anonymous feedback tools are often introduced to compensate for cultural hesitation. They can be useful, but only under one condition.

Leadership must consistently close the loop.

When feedback is collected but no visible action follows, trust erodes. Teams learn that honesty leads nowhere. Participation drops. Silence returns.

Effective feedback loops include:

- Safe reporting channels

- Root cause analysis without blame

- Concrete corrective actions

- Public sharing of themes and changes implemented

Anonymity is a bridge, not a destination. Long-term psychological safety depends on visible responsiveness, not hidden surveys.

Expert Insight

“Offshore performance issues are rarely caused by lack of competence. They are caused by delayed visibility. When teams feel safe raising questions early, MTTR drops and quality stabilizes. Psychological safety is not cultural theory. It is a delivery control.”

This reflects what SafeBooks observes across offshore audit, tax, and accounting engagements supported through structured offshore execution models.

Bindesh Jain, Tax Director (CA, CS), SafeBooks

Linking Psychological Safety to Delivery Metrics

High-performing offshore teams consistently show:

- Lower MTTR due to early escalation

- Reduced defect density from proactive clarification

- Stable cycle times with fewer end-stage surprises

These outcomes are not achieved through stricter monitoring. They emerge when offshore professionals feel safe enough to surface uncertainty early.

This is why firms that invest in psychological safety alongside operational discipline see stronger results from offshore back-office support teams.

Leadership Behaviors That Reduce Cultural Friction

Leaders shape safety through behavior, not policy.

Effective leaders:

- Invite offshore voices first in meetings

- Ask clarification-oriented questions

- Praise transparency, not just outcomes

- Address mistakes privately and learning publicly

These behaviors signal that early disclosure is valued more than perfect execution, aligning offshore teams with the accountability expected in dedicated professional delivery teams.

A New Operating Model for Offshore Performance

High-performing offshore teams are not controlled into success. They are enabled into it.

Psychological safety reduces Mean Time to Resolution. It lowers defect density. It stabilizes delivery. These outcomes directly affect client satisfaction, audit quality, and risk exposure.

Psychological safety is not cultural accommodation. It is execution infrastructure.

Firms that want offshore teams to operate as accountable delivery partners rather than task executors need systems, leadership behaviors, and execution support designed for this reality. This is the model SafeBooks applies across offshore audit, accounting, and tax teams supporting US firms. You can connect with SafeBooks to discuss how this operating model works in practice for your firm.

FAQS

What is psychological safety in offshore teams

How does psychological safety affect MTTR

Are anonymous feedback tools enough

Does psychological safety reduce accountability

Is this relevant beyond software teams

-

Director (CA, CS)

A Chartered Accountant and Company Secretary with over 11 years of experience, Bindesh specializes in direct taxation, estate planning, and statutory compliance. He helps U.S.-focused firms navigate complex tax issues with precision and foresight, while ensuring every SafeBooks engagement meets legal and procedural expectations.