The No Tax on Tips deduction 2025, introduced under the One Big Beautiful Bill Act (OBBBA), changes how tip income is taxed for millions of U.S. workers. For tax years 2025 through 2028, eligible workers can deduct up to $25,000 of qualified tip income from their federal taxable income. For CPA firms, this is not just a new rule but a new area of diligence that requires careful verification of client occupations, income thresholds, and documentation practices.

1. Legislative Overview and Implementation Timeline

The deduction applies retroactively from January 1, 2025, through December 31, 2028, under Public Law 119-21.

- Preliminary list of qualifying occupations issued September 2, 2025 (ADP)

- Proposed IRS regulations released September 19–22, 2025 (Bipartisan Policy Center)

- Final list expected in October 2025 (IRS.gov)

Because it is an above-the-line deduction, it benefits both standard deduction and itemizing taxpayers. For reliable updates, refer to IRS.gov and Kiplinger’s 2025 Tax Overview.

2. Deduction Mechanics and Income Limits

Core provisions:

- Up to $25,000 per return in qualified tip income deduction (IRS.gov)

- Applies only to voluntary tips from customers

- Deduction reduces Adjusted Gross Income (AGI), which can influence other credits

Phase-outs:

- Single filers: full benefit up to $150,000 MAGI; phases out through approximately $400,000 (Bipartisan Policy Center)

- Joint filers: full benefit up to $300,000 MAGI; phases out through approximately $550,000 (IRS.gov)

- Married filing separately: not eligible

This deduction replaces shorter-term hospitality-related tax credits from 2024 and reflects a longer-term focus on supporting the service economy.

3. Occupational Eligibility and SSTB Exclusions

To qualify, a worker must:

- Be in one of the 68 Treasury-approved occupations where tips were customarily received on or before December 31, 2024 (ADP)

- Not be in a Specified Service Trade or Business (SSTB) such as law, accounting, finance, or performing arts

Example:

A bartender in a hotel qualifies because tipping is customary, while a lawyer who receives a gratuity from a client does not, because legal services are an SSTB.

CPA firms must verify both occupational codes and employer industry classifications to confirm eligibility.

4. What Counts as a Qualified Tip

A tip qualifies only if it meets all of these conditions:

- It is voluntary and determined by the customer

- Paid via cash, card, or eligible electronic payment

- Received directly or through a documented tip pool

- Reported on Form W-2, 1099-NEC, or Form 4137 (Littler)

- Supported by reliable documentation such as daily logs or POS reports

Tips that do not qualify include automatic service charges, unreported cash tips, or employer-issued “tips.”

5. Reporting and Payroll Adjustments

Starting with the 2026 tax year, employers must use Box 14b (Treasury Tipped Occupation Code) on the W-2 form. Employers should begin system updates now, even though 2025 forms follow standard reporting under transition relief.

Key employer actions:

- Update payroll tracking for qualified vs. non-qualified tips

- Revise tip-pooling policies and allocations

- Maintain FICA withholding and reporting since Social Security and Medicare still apply

6. Screening Checklist for CPA Firms

When reviewing a client’s eligibility, confirm the following:

- Occupation is on Treasury’s approved list

- No SSTB conflict exists

- MAGI is within the applicable range

- Tips are voluntary and properly reported

- Documentation supports the deduction

- Filing status is appropriate (joint if married)

- Valid Social Security number(s) are provided

Using a consistent checklist like this helps firms reduce oversight errors and standardize their review process.

7. IRS Audit Risk Factors

The IRS is expected to scrutinize early filers under this rule. High-risk triggers include:

- Occupations not listed under Treasury codes

- Deductions disproportionate to reported wages

- Service charges misclassified as tips

- SSTB professionals attempting to qualify

- Lack of detailed tip logs or allocation records

Proper documentation such as daily logs, POS data, and verified deposits remains the best defense against an IRS audit. Maintaining these records throughout the year ensures transparency and accuracy in every return.

8. State and Local Tax Variations

The deduction currently applies only to federal returns. States like California have chosen not to conform, meaning tip income may still be taxable at the state level (American Progress). CPA firms serving multi-state clients should confirm conformity before preparing returns.

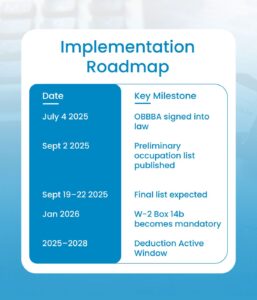

9. Implementation Roadmap

By aligning client onboarding and payroll updates with this schedule, firms can ensure smooth compliance.

Expert Insight

“The No Tax on Tips deduction rewards consistency, not assumption. Firms that confirm occupation codes, verify voluntary tip sources, and maintain daily logs will find compliance much easier. The real challenge is not in claiming the deduction but in substantiating it.”

-Anshul Agrawal

Accounts Director (CA), SafeBooks Global

What This Means for CPA Firms

Treating this deduction as a documentation exercise rather than a quick benefit helps firms add measurable value and lower client audit exposure.

Need Expert Help with the No Tax on Tips Deduction?

If your firm needs support verifying eligibility, adjusting payroll systems, or training staff on new compliance procedures, the team at SafeBooks Global can help. We partner with U.S. CPA firms to strengthen recordkeeping, simplify tax preparation, and ensure every return is audit-ready.

Start a conversation today to see how remote accounting and tax support can simplify compliance for your clients.

FAQS

Can self-employed workers claim the deduction?

Yes, if their occupation appears on the Treasury list and the tip income is reported correctly. The deduction cannot exceed net business income.

Do credit-card tips qualify?

Yes, as long as the tip amount is voluntary and properly reported. Card and app-based payments are included.

What happens if a client exceeds the income threshold?

Once MAGI exceeds $150,000 (single) or $300,000 (joint), the deduction begins to phase out and ends at about $400,000 and $550,000 respectively. (Bipartisan Policy Center)

Are states required to follow the federal deduction?

No. Each state decides whether to conform. CPA firms must verify state tax codes before filing. (American Progress)

Are tips still subject to Social Security and Medicare tax?

Yes. Payroll taxes remain unchanged. Employers must continue to withhold and report FICA on all tip income.

-

Director (CA)

Anshul is a detail-driven Chartered Accountant who works closely with CPA firms and small businesses to deliver high-impact accounting solutions. With a decade of hands-on experience in U.S. taxation, audits, and workflow optimization, he ensures every client receives consistent, quality-driven support from SafeBooks’ global team.