Reporting, Payroll Coding, and Client Guidance for 2025–2028

The passage of the One Big Beautiful Bill Act in July 2025 introduced a new federal income tax deduction commonly referred to as “No Tax on Overtime.” Despite the headline language, this is not a payroll exclusion and not a change to wage taxation. It is a temporary individual income tax deduction for the premium portion of federally required overtime pay.

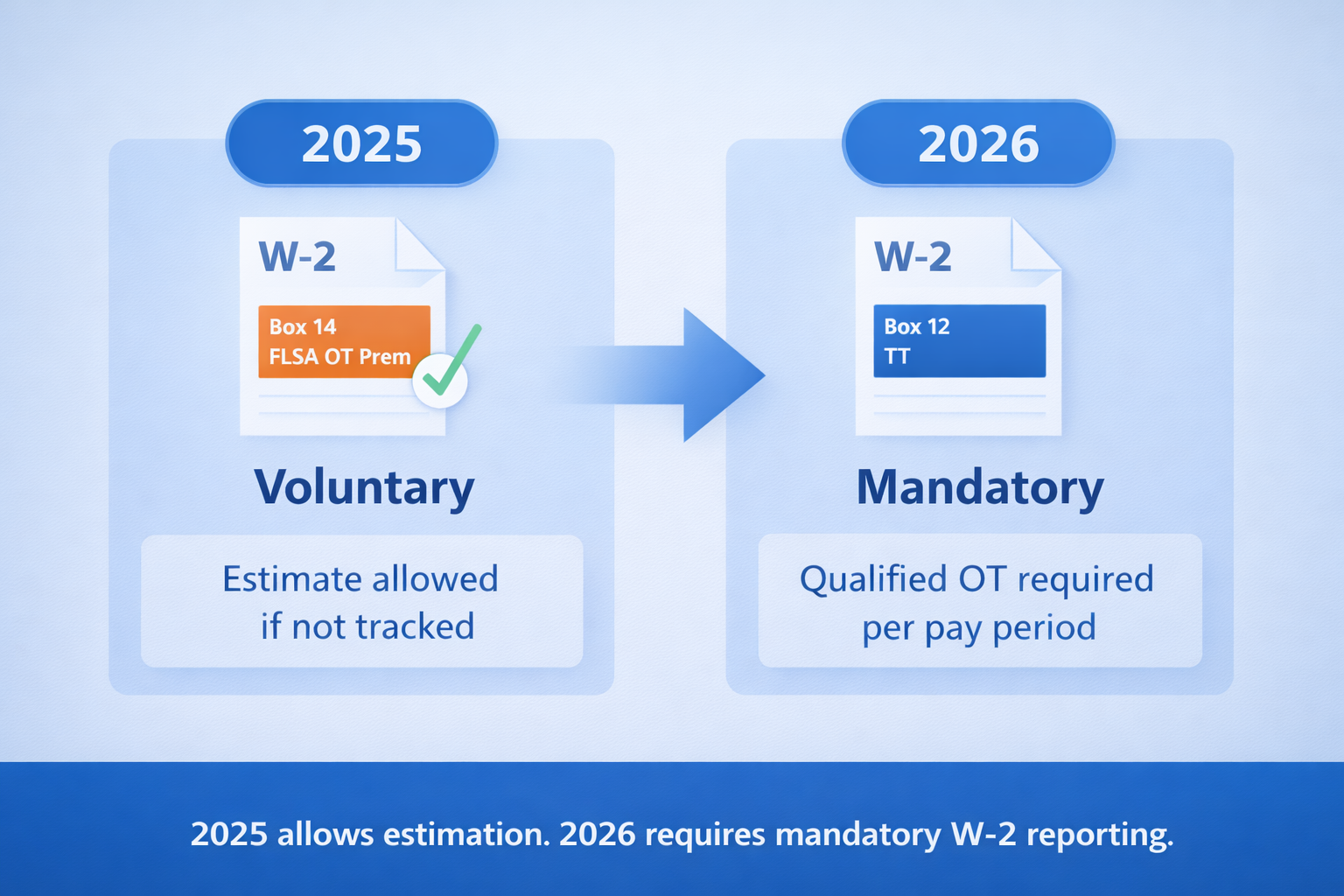

For accounting firms, payroll processors, and employers, the rule creates immediate reporting obligations. While 2025 benefits from limited transition relief, 2026 introduces mandatory W-2 reporting requirements that cannot be satisfied retroactively. Firms that do not update payroll logic now risk incorrect employee deductions, amended returns, and audit exposure.

This guide explains how the deduction works, what qualifies, how payroll systems must calculate and report it, and how firms should advise clients through the 2025–2028 window.

What the “No Tax on Overtime” Rule Actually Does

The qualified overtime deduction allows eligible employees to deduct only the premium portion of overtime pay from federal taxable income for tax years 2025 through 2028.

Important clarifications:

- Overtime wages remain fully taxable at payroll

- Federal withholding still applies

- Social Security and Medicare taxes still apply

- The benefit is claimed on Form 1040, not in payroll

- Accurate payroll reporting determines whether the deduction is defensible

This structure mirrors other employee-level deductions that depend on employer reporting accuracy rather than payroll exclusion. For context, see how SafeBooks addresses complex employee reporting in its payroll and compliance support services.

What Qualifies as Qualified Overtime Compensation

Only overtime required under the Fair Labor Standards Act qualifies.

The deduction applies only to the premium portion, not the full overtime wage.

Example:

- Regular rate: $30 per hour

- Overtime paid: $45 per hour

- Base portion: $30

- Premium portion: $15

Only the $15 qualifies for the deduction.

If an employer pays double time or other enhanced rates, the deductible amount is still limited to the 0.5x premium required under federal law. Any excess premium is not deductible.

The Weighted Regular Rate Rule: A Critical Payroll Risk

One of the most common payroll errors involves the weighted regular rate of pay.

Under the FLSA, when an employee works at multiple pay rates in the same workweek, the regular rate is not the rate of the specific hour worked. It must be calculated as a weighted average of all compensation earned during the week, excluding permitted exclusions.

This matters because:

- The 0.5x premium must be calculated on the blended rate

- Payroll systems that calculate overtime using a single hourly rate will understate or overstate the deductible amount

- Errors here directly affect W-2 reporting accuracy and employee deductions

Payroll platforms must ensure that the overtime premium reported for tax purposes is derived from the correct blended regular rate, not a simplified base rate.

What Does Not Qualify

The following payments do not qualify:

- Straight time paid above 40 hours

- State-only daily overtime unless weekly hours exceed 40

- Shift differentials

- Holiday pay

- Discretionary bonuses

- Contractual premiums beyond FLSA requirements

This distinction is especially important for employers operating in states with daily overtime rules such as California.

Income Limits and Phaseouts

The deduction is capped and subject to income-based phaseouts.

Filing status | Maximum deduction | Phaseout begins | Fully phased out |

Single / HOH | $12,500 | $150,000 MAGI | $275,000 MAGI |

Married filing jointly | $25,000 | $300,000 MAGI | $550,000 MAGI |

The deduction is not available to taxpayers filing Married Filing Separately.

Why 2025 Payroll Accuracy Still Matters

Although the IRS granted penalty relief for 2025, payroll systems must still be able to:

- Isolate overtime premium

- Preserve pay-period level data

- Support reasonable employee estimates

Without this data, employees may lose the deduction or face IRS scrutiny. This mirrors issues seen in prior reporting changes discussed in SafeBooks’ analysis of evolving payroll reporting obligations.

2025 Transition Relief and Acceptable Reporting Methods

For 2025 only, employers are not required to separately report qualified overtime on the W-2.

Acceptable methods include:

- W-2 Box 14 with labels such as “FLSA OT Premium”

- Secure employee portals

- Supplemental year-end statements

Overtime wages must still be included in Box 1.

IRS-Approved Estimation Methods for 2025

If payroll systems did not track the premium portion during part of 2025, employees may use these formulas:

Overtime rate paid | Deductible portion |

1.5x | One-third of total overtime pay |

2.0x | One-quarter of total overtime pay |

3.0x | One-sixth of total overtime pay |

These formulas isolate the federally required premium only.

Mandatory Reporting Beginning in 2026

Starting January 1, 2026:

- Qualified overtime must be tracked per pay period

- W-2 Box 12 Code TT is mandatory

- Penalties apply for incorrect reporting

Payroll systems must:

- Create a dedicated FLSA overtime premium code

- Exclude state-only premiums

- Apply weighted regular rate calculations

- Map totals correctly to Code TT

Firms should confirm payroll provider readiness early. SafeBooks routinely supports firms with

back-office payroll system alignment.

Federal vs State Law Conflicts

Only overtime required under federal law qualifies.

Examples:

- California daily overtime does not qualify unless weekly hours exceed 40

- Double time qualifies only up to the federally required premium

State income tax treatment varies. Many states require addbacks. Multistate employers must reconcile federal deductions with state conformity rules, a challenge similar to those outlined in SafeBooks’ multistate compliance resources.

Workforce Classification Risk

The deduction increases the financial value of non-exempt status. This:

- Raises misclassification exposure

- Increases potential damages in wage claims

- Makes FLSA audits more expensive

Firms advising clients on payroll should align this rule with broader wage and hour risk advisory services.

Expert Insight

“The biggest risk is not tax law interpretation. It is payroll systems that cannot defensibly separate the FLSA premium using the correct weighted regular rate. That is where audits will focus.”

Bindesh Jain, Tax Director (CA, CS), SafeBooks

A Practical Payroll Readiness Framework

For 2025

- Identify non-exempt employees

- Estimate qualified overtime using IRS formulas

- Provide employee documentation

For 2026

- Implement FLSA premium-specific codes

- Test W-2 Box 12 Code TT mapping

- Validate weighted regular rate logic

- Train payroll and HR teams

This transition mirrors other payroll modernization efforts discussed in SafeBooks’ remote accounting workflow guidance.

Why This Rule Demands Early Action

The deduction is temporary, but payroll data errors are permanent once W-2s are issued. Firms that wait until filing season will be forced into amended returns, employee disputes, and avoidable compliance risk.

Accurate payroll architecture is now a tax planning requirement.

Need Help Implementing Overtime Reporting Correctly?

The qualified overtime deduction places new technical demands on payroll systems, W-2 reporting, and employee documentation. Errors cannot be fixed retroactively once filings are issued.

If your firm or your clients need help with:

- Payroll code restructuring for FLSA overtime premiums

- W-2 Box 12 Code TT readiness for 2026

- Multi-state payroll and federal-state reconciliation

- Payroll audits and documentation defensibility

You can speak with the SafeBooks tax and payroll team to review your current setup and identify gaps before reporting becomes mandatory.

FAQS

Is overtime tax free at payroll?

Which portion qualifies for the deduction?

Does the deduction reduce Social Security or Medicare tax?

Can employees adjust withholding to reflect the deduction?

Does the deduction continue after 2028?

-

Director (CA, CS)

A Chartered Accountant and Company Secretary with over 11 years of experience, Bindesh specializes in direct taxation, estate planning, and statutory compliance. He helps U.S.-focused firms navigate complex tax issues with precision and foresight, while ensuring every SafeBooks engagement meets legal and procedural expectations.