Why 2026 Is the Real Decision Year

The expansion of the State and Local Tax deduction cap to $40,000 marked the most significant federal tax shift for high-tax state residents since the TCJA. While the higher cap first applied in 2025, 2026 is the year when strategy truly matters.

Starting in 2026, multiple provisions converge: tighter Alternative Minimum Tax thresholds, a new limitation on itemized deduction value, and increased interaction between filing status and pass-through entity elections. Advisors who treat the $40,000 cap as a simple increase risk misallocating deductions and creating avoidable tax exposure.

Safebooks works with both U.S. accounting firms and business owners navigating these structural changes through detailed, multi-year modeling rather than one-year optimization.

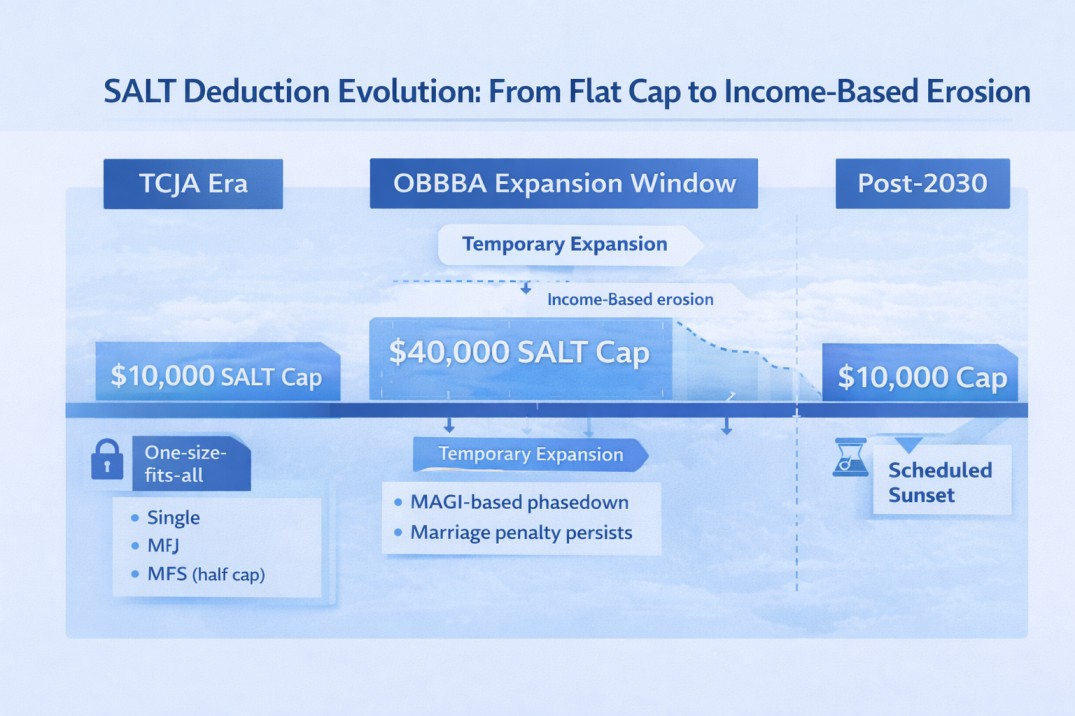

The Evolution of SALT: From TCJA to the OBBBA Framework

The original $10,000 SALT cap introduced under the TCJA applied uniformly, regardless of income or filing status. The One Big Beautiful Bill Act replaced that rigidity with a temporary expansion paired with income-based erosion.

The cap applies at the return level, not the individual level, and remains scheduled to revert to $10,000 in 2030.

SALT Cap Trajectory

Tax Year | Joint / Single Cap | MFS Cap | Notes |

2024 | $10,000 | $5,000 | TCJA baseline |

2025 | $40,000 | $20,000 | Expansion begins |

2026 | $40,400 | $20,200 | 1% inflation adjustment |

2029 | ~$41,600 | ~$20,800 | Final expansion year |

2030 | $10,000 | $5,000 | Sunset |

The modest 1% inflation adjustment means the real value of the deduction declines over time, particularly for taxpayers with rising property taxes.

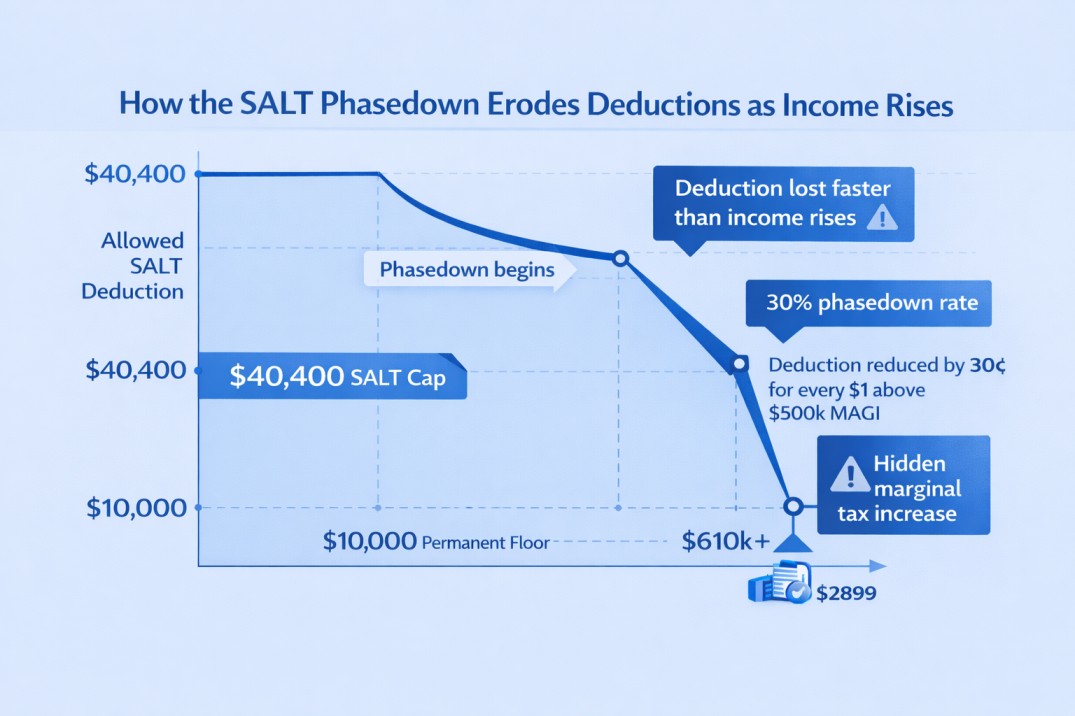

The SALT Phasedown and the “SALT Torpedo”

Beginning in 2025 and continuing into 2026, the expanded SALT cap is reduced once Modified Adjusted Gross Income exceeds:

- $500,000 for single and married filing jointly

- $250,000 for married filing separately

The reduction equals 30 percent of income above the threshold until the deduction reaches the permanent $10,000 floor.

Phasedown Example (Joint Filers)

MAGI | Cap Reduction | Allowed SALT |

$500,000 | $0 | $40,400 |

$550,000 | $15,000 | $25,400 |

$600,000 | $30,000 | $10,400 |

$610,000+ | Fully phased | $10,000 floor |

This creates a narrow income band where incremental earnings trigger both higher tax and lost deductions. Safebooks frequently models this impact for firms delivering tax support services to high-income professionals.

The Marriage Penalty Persists

The OBBBA preserves the structural marriage penalty embedded in the TCJA.

Two unmarried taxpayers can each qualify for a $40,000 cap. Once married and filing jointly, the household is limited to a single $40,000 cap and a single $500,000 phasedown threshold.

Filing Status Comparison (2026)

Status | SALT Cap | Phaseout Threshold |

Single | $40,400 | $500,000 |

MFJ | $40,400 | $500,000 |

MFS | $20,200 | $250,000 |

For couples with uneven incomes, Married Filing Separately may occasionally preserve a larger SALT deduction for the lower-earning spouse if their income remains below $250,000. This must be balanced against less favorable brackets and higher AMT exposure.

The 35 Percent Itemized Deduction Haircut (Effective 2026)

Beginning in 2026, taxpayers in the top income tier face a new limitation: the tax benefit of itemized deductions is capped at 35 percent, even when the marginal rate is 37 percent.

This applies to SALT, charitable contributions, and mortgage interest reported on Schedule A.

Entity-level deductions, including PTE taxes, are not subject to this haircut. This difference alone often justifies maintaining a PTE election even when total SALT falls below the $40,000 individual cap.

Why the PTE Election Still Matters in 2026

The Pass-Through Entity Tax election allows partnerships and S corporations to deduct state income tax at the entity level, bypassing the SALT cap entirely.

In 2026, PTE elections deliver three advantages:

- Deduction at the full 37 percent marginal rate

- Preservation of the personal standard deduction

- Reduction of MAGI for SALT phasedown and AMT purposes

Safebooks supports firms evaluating PTE elections through bookkeeping and accounting services for accounting firms where entity-level reporting accuracy is critical.

AMT Risk Expands in 2026

While AMT exemption amounts remain elevated, the phaseout threshold for joint filers resets downward in 2026, increasing exposure for high-tax state residents.

SALT deductions are added back for AMT purposes. A higher SALT cap therefore increases AMTI and raises the risk of triggering AMT, particularly for married filers.

This interaction is frequently overlooked without multi-scenario modeling.

Expert Insight

“The expanded SALT cap gives clients a false sense of simplicity. In 2026, the interaction between SALT, AMT, filing status, and PTE elections means the right answer is rarely intuitive. Firms that model across entities and years consistently outperform one-year optimization.”

Bindesh Jain, Tax Director (CA, CS), SafeBooks

Strategic Takeaways for Advisors

- Manage MAGI aggressively to avoid SALT phasedown exposure

- Maintain PTE elections where entity-level deductions outperform Schedule A

- Reevaluate filing status annually for high-income married couples

- Model AMT impact before accelerating SALT or charitable deductions

- Plan with the 2030 SALT sunset in mind

For deeper technical planning resources, explore the SafeBooks tax and accounting blog.

Planning for the SALT Window, Not the Headline

The $40,000 SALT cap is not a blanket tax cut. It is a temporary planning window that rewards structured modeling and penalizes assumptions.

Advisors who treat SALT, PTE elections, and filing status as interconnected levers rather than isolated decisions will protect client outcomes through 2026 and beyond.

Firms seeking structured support can contact SafeBooks to discuss advanced tax planning workflows.

FAQS

Does the $40,000 SALT cap apply in 2026?

Is the SALT phasedown still in effect in 2026?

Can married couples double the SALT cap by filing separately?

Does the 35 percent deduction haircut affect PTE elections?

When should firms reassess PTE elections?

-

Director (CA, CS)

A Chartered Accountant and Company Secretary with over 11 years of experience, Bindesh specializes in direct taxation, estate planning, and statutory compliance. He helps U.S.-focused firms navigate complex tax issues with precision and foresight, while ensuring every SafeBooks engagement meets legal and procedural expectations.