Accurate Remote Tax Preparation When You Need It

US-trained tax professionals working under your firm’s brand. Scalable, secure, and timeline-driven.

Why Remote Tax Makes Sense?

Handle seasonal tax peaks without Onshore hiring

Save 40–60%

compared to

in-house staff.

Onboard Skilled Tax

Experts instantly

Meet all Federal

&

Multi-State

deadlines

Maintain

Confidential

and

Branded Delivery

What We Offer?

Reliable, U.S.-Aligned Remote Staffing for Bookkeeping, Tax Prep, and Audit Support.

BENEFITS

Scope of

Work

Qualifications & Experience

Communication

Additional

Capabilities

(All Roles)

Tax Preparer

(Business & Individual)

- Prepare 1040s, 1120, 1120S, & 1065 tax returns using software.

- Gather & organize client tax docs. & input relevant data,

- Perform basic tax planning calculations & spot missing info.

- Ensure timely filing with adherence to IRS guidelines

- B-Com/B-Acc. (1 to 3 years of tax preparation experience.)

- Trained on U.S. tax forms and seasonal workflows.

- Average written English; basic spoken English for internal coordination.

Senior

Tax Preparer

- Prepare complex tax returns for multi-state & high net-worth.

- Review tax data for accuracy and perform tax projections

- Identify deductions, credits, and compliance issues

- Assist clients during tax season with follow-up and clarifications

- CA Inter (Equivalent to M-Acc.) or EA (3–5 yrs. of U.S. tax law.

- Skilled in Lacerte, UltraTax, or similar tools.

- Good written English; primary spoken skills for clarifications and discussions.

Tax

Reviewer

- Review 1040, 1120, 1065, & other returns for accuracy & compliance.

- Do final checks on depreciation, carry-forwards, & analysis.

- Coach junior preparers & guide on tax treatment & documents.

- Communicate errors & recomm. clearly to the tax team.

- EA or CPA-track with 5+ years of tax experience.

- Adv. tax software proficiency & strong technical review skills.

- Good written English; primary spoken skills to lead review calls and resolve issues.

- Individual returns (1040, Schedule C & E, etc.)

- Business returns (1120, 1120S, 1065)

- State & local tax filings

- Multi-state and multi-entity tax coordination

- Tax preparation workpaper prep (adjusted trial balance, schedules)

- E-filing coordination & support.

- Backlog catch-up & prior-year filings.

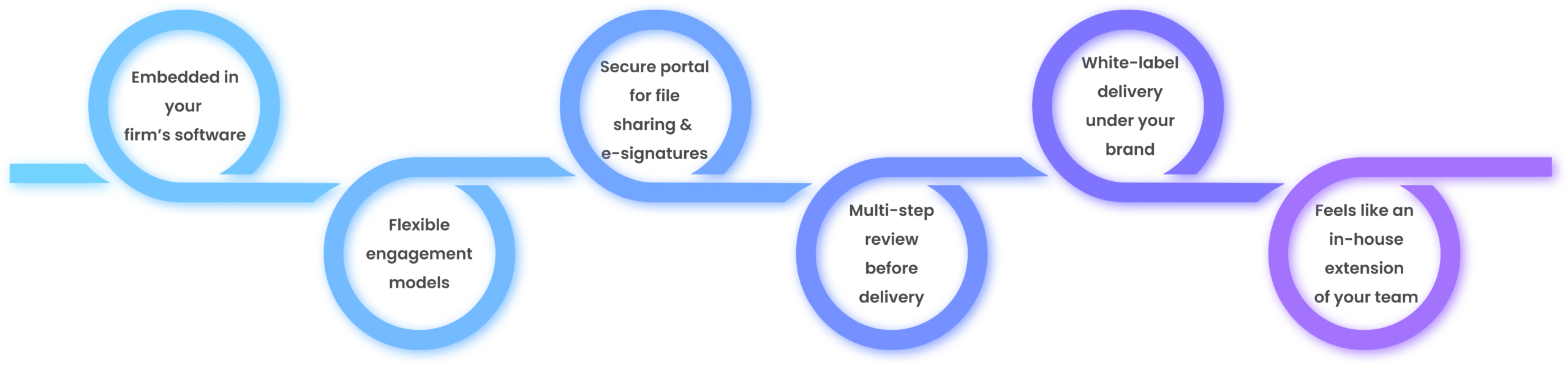

Built to Fit Your Firm’s Workflow

Flexible Tax Prep Support That Feels In-House

How It Works?

Our Engagement Process

Discovery & Deadline

Alignment

Secure Client Data Transfer

Dedicated Tax Team

Routing

Preparation & Quality

Review

File Upload & Partner

Review

E-filing &

Follow-up

Security & Data Privacy

Enterprise-grade infrastructure to protect your data, ensure privacy, and support secure remote accounting operations, built for compliance and peace of mind.

WISP compliance / ISO 27001 certification

Encrypted data transfer & daily backups.

VPN secure workstations & access controls.

Strict NDA protocols for team members.

Role-based access within your software.

U.S.-based support for escalations or audits.

Real Results from Remote Engagements

Accurate filings, faster turnarounds, quick backlog cleanup, and multi-state tax expertise.

0

%+

e-filing accuracy

0

%

Average time savings vs in-house staff

<

0

days

Backlog cleanup cleared

0

+

Multi-state return experience

Testimonials

Consistent. Compliant. Trusted.

Corporate tax prep is now stress-free thanks to Safebooks’ structured process and quick turnarounds.

Franchise filings across states were a pain point. SafeBooks turned it into a smooth system.

Their team handled our peak-season workload without missing a single deadline. I could focus on client relationships instead of chasing filings.

Complex multi-state corporate returns were completed accurately and ahead of schedule. This level of efficiency is rare.

From gathering documents to e-filing, the process was seamless. The communication was consistent and clear at every stage.

Tools Tools We Work With

We are compliant with global data security protocols and partner with industry-leading cloud software providers to maintain service excellence.

Need Help with Bookkeeping or Audit Work?

Add-on services are available for CPA firms seeking tax preparation or audit support.

FAQS

Can we review returns before filing?

Yes, all returns go through your final review before e-filing.

Are you up to date on state tax law changes?

Yes, our team stays current with federal and state tax regulations.

What’s your policy on multi-state returns?

We handle multi-state filings regularly, including compliance and coordination.

Will you use our tax software?

Yes, we work directly in your preferred software like UltraTax, Drake, or Lacerte.

How do you handle tax year backlogs?

We quickly assign a dedicated team to clear backlog returns—often within 10 days.

How do you ensure data security during tax preparation?

We follow IRS WISP compliance protocols, use ISO 27001-certified systems, VPN-secured workstations, encrypted transfers, and strict access controls.

Scale for Season. Stay Profitable Year-Round.

Let’s get started with your custom staffing solution today.