Sales Tax Support

That Scales With Your Advisory Firm

Offshore support built for SALT specialists. From filings to research and reconciliations,

we handle your sales tax backend on time and under your brand.

Why Remote Sales Tax Support Helps

Free up your in-house experts from repetitive tasks

Save up to 60% without losing quality

Manage multi-state filings with confidence

Improve accuracy and speed during busy seasons

Protect your brand with white-labeled support

What We Offer?

Accurate, U.S.-aligned remote staffing for sales tax filings, research, and compliance support.

BENEFITS

Scope of

Work

Qualifications

& Experience

Communication

Sales Tax Assistant

- Prepare monthly, quarterly, and annual sales and use tax returns.

- Register and manage state-level and multi-jurisdictional tax accounts.

- Maintain exemption certificate databases.

- Conduct nexus research and track filing requirements.

- Respond to state tax notices and manage correspondence.

- Reconcile sales tax data and prepare audit-ready documentation.

- Update and manage Avalara, Vertex, and TaxJar dashboards.

- Professionals with M.Com, B.Com, CA Inter, or CPA-track backgrounds.

- Trained in U.S. sales and use tax laws, including Wayfair nexus rules.

- Certified in Avalara, TaxJar, or Vertex platforms.

- Experience with local taxes in states like Colorado, Louisiana, & Alabama.

- Strong written English and availability aligned to your timezone.

- Clear documentation and fully white-labeled deliverables.

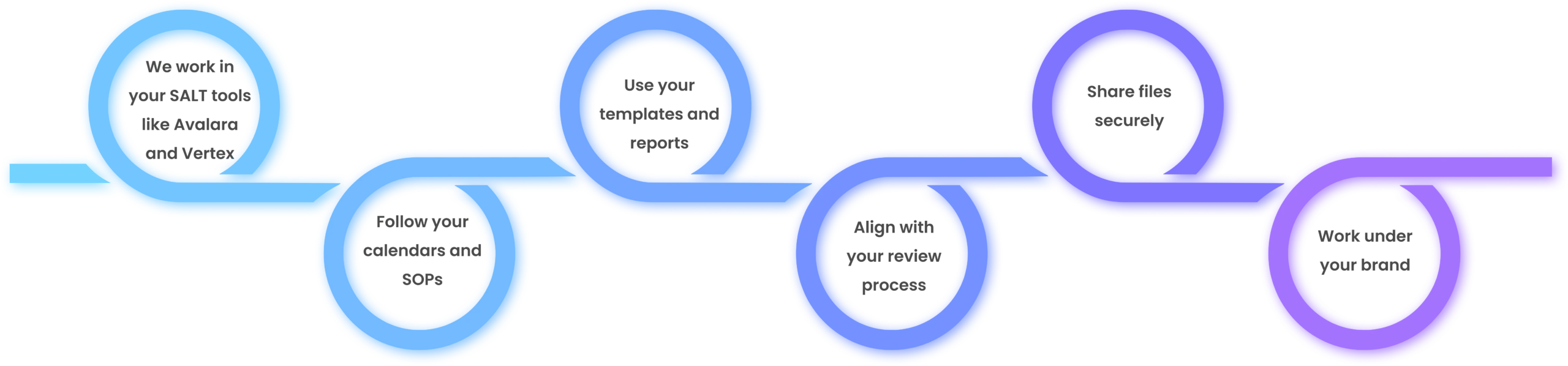

How We Fit Inside Your Firm

Smooth collaboration. Zero disruption to your workflow.

How It Works?

Our Engagement Process

Discovery Call and SALT

Workflow Review

Onboarding and Secure

Access Setup

Filings, Research, and

Reconciliation

Internal Review and Client

Delivery

Weekly or Biweekly

Progress Sync

Security & Data Privacy

Strict protocols to protect your sales tax data, ensure confidentiality, and support secure remote operations. Everything is built for compliance and peace of mind.

Encrypted file sharing & role-based access controls

VPN workstations with MFA security

Daily backups and access activity logs

NDA agreements signed by every team member

Client-specific access permissions

Fully white-labeled for confidentiality

Real Results from SALT Support Engagements

Real impact through reliable processes and measurable outcomes.

0

+

Sales tax returns filed across 40+ states every month

0

%

Accuracy rate in multi-jurisdictional filings

0

x

Client capacity scaled by SALT advisory firms

0

%

White-labeled delivery with client confidentiality

Testimonials

Consistent. Compliant. Trusted.

They took over sales tax setup and filings for 12 clients, flawless execution every time.

With SafeBooks handling sales tax, I never worry about missed state deadlines again.

Multi-state filings are no longer a bottleneck. Their accuracy and speed make compliance stress-free.

Their team manages exemption certificates, reconciliations, and notices without us having to chase updates.

From nexus research to ongoing filings, everything is done in line with our process and brand.

Tools We Work With

We work inside your existing SALT platforms and accounting stack. Our team is trained on industry-standard tools and aligned with global data security protocols to ensure smooth, secure delivery.

Need Support Beyond Sales Tax?

CPA firms often extend SALT engagements to include tax preparation and audit support, delivered securely under your brand.

FAQS

Can you file returns on our behalf?

We prepare filings and supporting documents. Final submission is handled by your team or through platforms like Avalara or Vertex.

Do you support local-level tax filings?

Yes. We support city, county, and parish-level sales taxes in states like Colorado, Alabama, and Louisiana.

How secure is client data?

All workstations are VPN-secured, files are encrypted, and access is limited by role-based permissions and NDA compliance.

Can we use your team for seasonal spikes only?

Yes. We offer flexible models including project-based, part-time, and seasonal staffing.

Will your team communicate with our clients?

No. All work is white-labeled and internal. Your clients only interact with your firm.

Can you assist with nexus research and account setup?

Yes. We handle new account registrations, track nexus changes, and ensure filing requirements are updated for each jurisdiction.

Let Us Handle Sales Tax While You Focus on Strategy

Partner with a reliable offshore team for accurate, on-time SALT compliance.