Remote Audit Support

Built for Busy Seasons

Boost your audit capacity with US GAAP trained professionals who work securely, accurately, and invisibly under your brand.

Why Remote Works for Modern CPA Firms?

Avoid hiring

pressures

during busy periods

pressures

during busy periods

Save 40–60%

compared to

in-house teams.

compared to

in-house teams.

Get Audit-Ready

Workpapers

from a trained team

Workpapers

from a trained team

Meet tight

deadlines without

compromising

Quality

deadlines without

compromising

Quality

Expand capacity

without

Client Disruption

without

Client Disruption

What We Offer?

Our audit support team covers high-volume and recurring audit tasks so your team can focus on analysis and client relationships.

Audit

Associates

Scope of

Work

Qualifications

& Experience

Communication

areas we handle

For Profit & Financial Audit

- Assist with planning and execution of audits.

- Perform testing of controls, transactions, and account balances.

- Prepare workpapers and document procedures.

- Report findings to the audit lead.

- CA Inter or B.Com/Accounting with 1–3 years' experience.

- Trained in U.S. GAAP and documentation standards.

- Good written English; basic to moderate spoken English for updates

EBP, HUD, CIRA, Not-for-Profit

- Handle audits of EBP, HUD, CIRA, & NFP entities.

- Perform plan-level testing and compliance checks.

- Maintain audit files and coordinate with U.S. teams.

- M.Com/Accounting with 2–4 years’ relevant experience

- Familiar with U.S. regulations and niche audit checklists.

- Good written English; moderate spoken English for syncs

Single Audit &

Yellow Book

Audit

- Execute audit steps for federal program audits.

- Assist with SEFA testing and compliance documentation.

- Support internal control reviews & peer-ready workpapers.

- CA Inter or audit-trained professionals.

- 2–4 years of experience in Yellow Book or Single Audits.

- Good written English; moderate spoken English for walkthroughs

Audit Senior

(Internal Audit

& SOX)

- Lead internal audits and SOX reviews.

- Perform risk assessment and control testing.

- Review junior auditors’ work and prepare reports.

- CA/CPA with 2–4 years’ experience

- Experts in audit software including CCH, Case Ware, & Advance Flow

- Skilled in COSO, risk control matrices, and documentation

- Strong written English; primary spoken communicator for client meetings

- Trial balance imports & lead sheets

- Substantive testing & sampling schedules.

- Workpaper prep (Cash, A/R, A/P, Inventory, PPE, etc.)

- PBC list coordination

- Payroll & depreciation tie-outs

- Control walkthroughs

- Drafting financials & footnotes

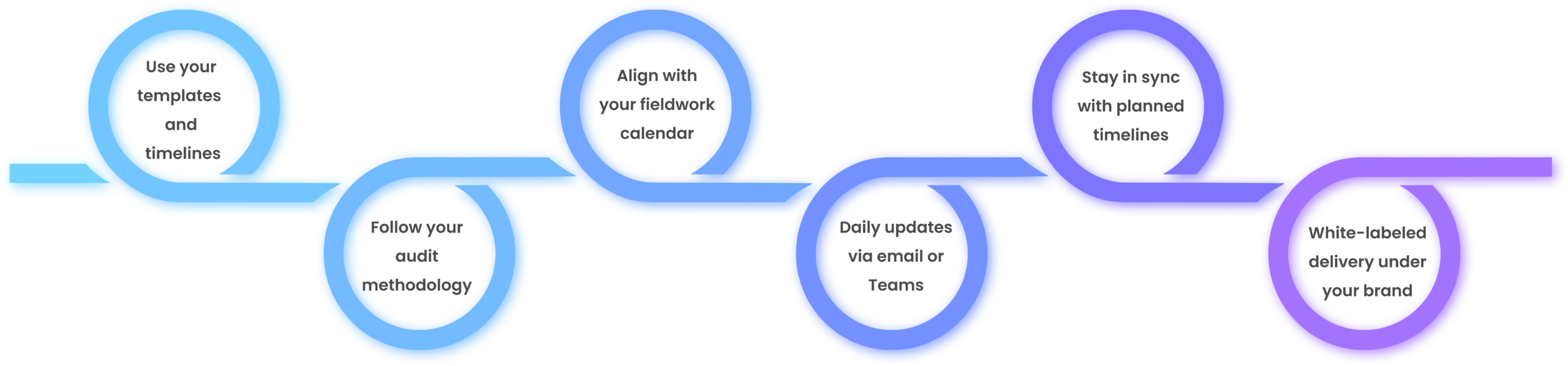

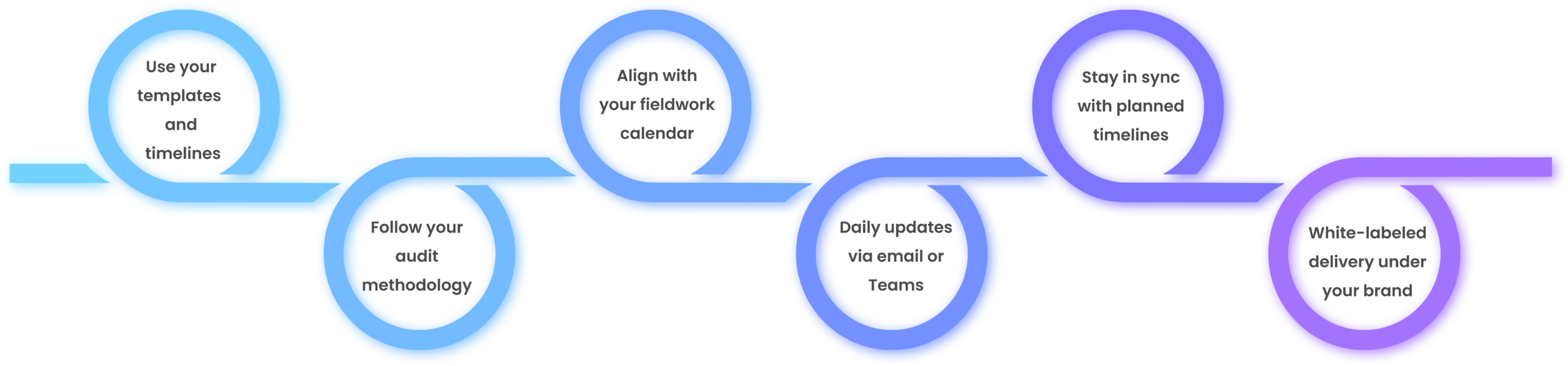

How We Integrate With Your Team

Workflows That Match Your Process, Not Ours

How It Works?

Our Engagement Process

Discovery Call & Scope

Finalization

Secure Setup & Access

Team Assignment

Workpaper Preparation +

QC Review

Partner Review + Feedback

Final File Delivery

Security & Data Privacy

Enterprise-grade infrastructure to protect your data, ensure privacy, and support secure remote accounting operations, built for compliance and peace of mind.

WISP compliance / ISO 27001 certification

ISO 27001-based internal controls

VPN or secure cloud file exchange

Daily backups & access restrictions

NDAs signed at team and firm level

No data stored or reused outside engagement

U.S.-based point of contact for compliance concerns

Real Results from Remote Engagements

Partner-approved, compliant audit support with faster turnaround and clear results.

0

+

audit sections completed in 2024

0

%

First-pass approval rate by audit partners

0

%

Faster completion of fieldwork

0

Trusted by firms in 25 states & 3 federal programs

Testimonials

Consistent. Compliant. Trusted.

Their audit prep saved us dozens of hours this busy season. Organized, reliable, and audit-ready.

he Safebooks audit team knows what U.S. reviewers expect. They make offshore support feel local.

We cleared a backlog of complex workpapers in record time. The attention to detail exceeded our expectations.

Having their team embedded into our workflow meant no learning curve. Everything was delivered partner-ready.

Their understanding of U.S. GAAP and compliance requirements made our fieldwork faster and stress-free.

Tools Tools We Work With

We are compliant with global data security protocols and partner with industry-leading cloud software providers to maintain service excellence.

Need Help with Tax or Audit Work?

Add-on services available for CPA firms seeking tax preparation or audit support.

FAQS

Can we assign only specific sections for audit support?

Yes, we can take on select sections based on your needs and deadlines.

Will your team follow our sampling and materiality guidance?

Absolutely. We work within your templates, thresholds, and audit methodology.

How do you ensure client data confidentiality?

We follow SOC 2 and ISO 27001 standards, use secure access, and enforce strict NDAs.

Are you trained in Yellow Book or EBP audits?

Yes, we have specialists experienced in Yellow Book, EBP, HUD, and NFP audits.

Can we scale up mid-engagement?

Yes, we can quickly add resources to match your changing workload.

Will you work in our audit software?

Yes, we work directly within your preferred tools such as CCH, CaseWare, and AdvanceFlow.

Ready to Boost Your Audit Capacity Without Hiring?

Let’s walk you through how remote audit support fits into your current workflow.