CPA firms across the United States are facing a widening gap between growing client workload and the number of qualified accounting professionals available locally. Increasing labor costs, tight deadlines, and expanding compliance requirements have pushed firms to explore hybrid global workforce models. Many firms now integrate offshore teams into their core operations to accelerate delivery and improve capacity.

The strongest outcomes emerge when offshore talent is supported by a firm management platform that provides visibility, traceability, accountability, and structure across distributed work environments. Technology becomes the connector that aligns people, process, and performance, turning offshore staffing into a strategic advantage rather than only a cost decision.

Why Firm Management Tools Are Essential for Offshore Collaboration

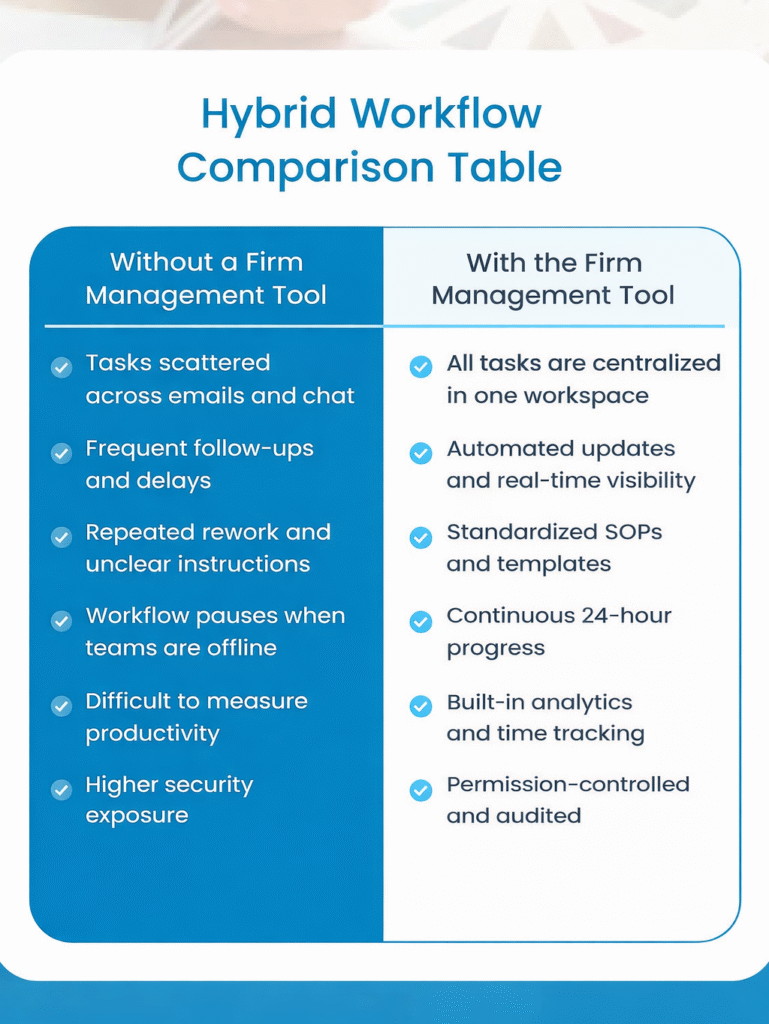

Working across multiple time zones and locations requires clarity and consistent processes. A firm management tool centralizes all workflow execution to ensure both teams operate inside a unified environment where every task is tracked, documented, and measured.

Key operational improvements

- One platform that consolidates tasks, documents, deadlines, and review notes

- Real time status visibility for partners and managers without manual follow up requests

- Standardized templates that eliminate variation in deliverables

- Automated reminders and approval routing to prevent delays

- Time tracking and analytics to measure productivity and accuracy

- Audit trails that support compliance and regulatory assurance

When offshore teams work inside the same workflow structure as onshore teams, alignment becomes natural, communication friction reduces, and output becomes consistent across the entire delivery chain.

Turning Time Zones into a 24 Hour Production Advantage

Firm management tools enable asynchronous collaboration, meaning work continues even when teams are offline. Instead of pausing overnight, tasks move continuously through the workflow.

Example shift cycle

- The U S team defines priorities and assigns tasks with documentation during their workday

- The offshore team receives the task queue and completes processing overnight

- The U S team returns to work with reports and reconciliations ready for review

This structure improves turnaround without adding internal supervision pressure or overtime costs.

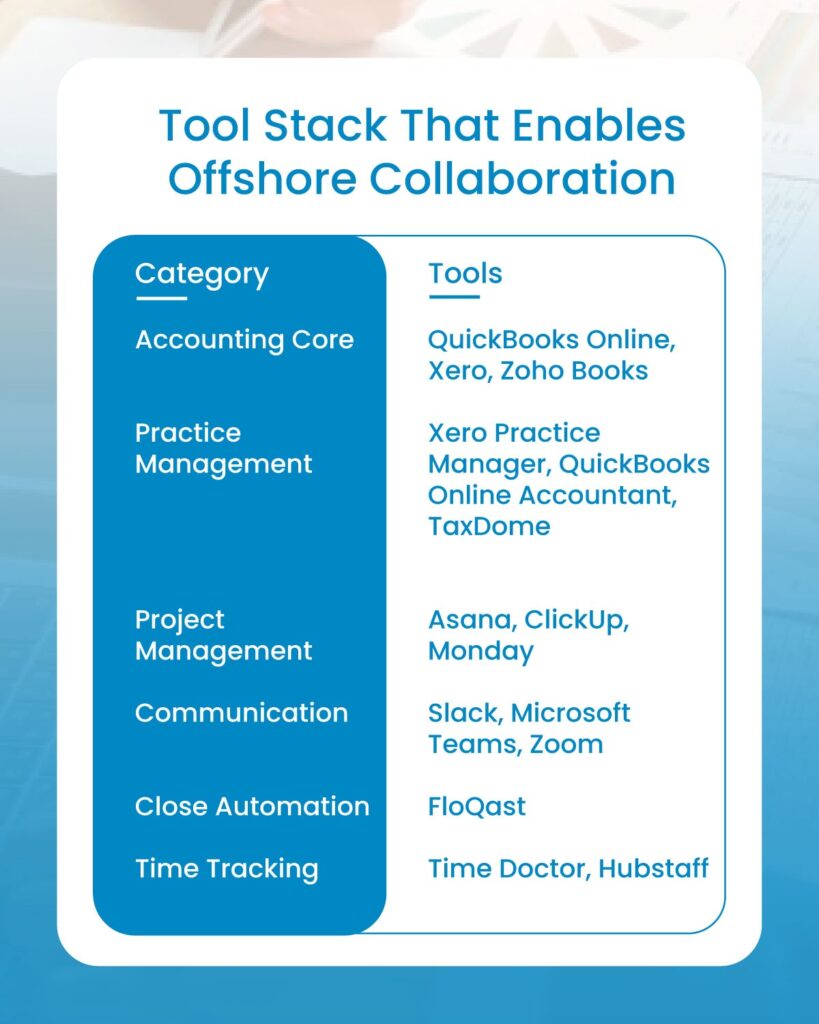

A unified ecosystem eliminates scattered work and improves accuracy through system based controls rather than manual intervention.

Compliance and Security: Protecting Data Across Borders

Security concerns increase when multiple environments and regions are involved. Firm management platforms protect sensitive data through structured supervision and controlled access.

Key protection layers

- Permission based access to limit sensitive information visibility

- Detailed audit logs tracking all changes and approvals

- Encrypted storage and secure document transfer

- Controlled authorization workflows with time stamped verification

- Version control to prevent errors caused by document duplication

For SafeBooks clients, maintaining financial data integrity is a core priority. Learn more about our approach to compliance: How SafeBooks Protects Client Financial Data

Real Example of Impact

A mid sized U S accounting firm shifted their month end close work to an offshore supported model integrated through a structured workflow system. Their close timeline improved from ten days to three days, and revision loops were reduced significantly once standardized templates and automated review checkpoints were implemented.

What Makes SafeBooks Different

SafeBooks does not simply provide offshore staffing. We build operational continuity. Our offshore teams work inside structured workflow frameworks, standardized documentation, and technology driven review processes. This model creates a unified operational structure rather than a disconnected outsourcing relationship. Reliability, process discipline, and data security are integrated from day one.

Expert Insight

“Hybrid teams outperform traditional staffing models when supported by structured workflow automation. A firm management tool creates the clarity and accountability required for secure and efficient collaboration across distributed workforces. When the process is designed correctly, firms achieve faster turnaround and consistent quality.”

-Bindesh Jain

Tax Director CA CS, SafeBooks Global

Moving Forward with a Stronger Operational Model

The future of accounting operations belongs to firms that combine global capacity with technology driven process structure. Offshore staffing alone cannot guarantee efficiency and software alone cannot eliminate bottlenecks. True performance transformation happens when both operate together inside a unified workflow system that strengthens visibility, consistency, and delivery speed.

Firms that adopt this approach improve scalability, strengthen profitability, and deliver faster and more reliable client experiences.

To speak with our team or request a consultation visit Contact Us andTo explore hybrid workflow implementation and offshore support visit Get Started

FAQS

How do firm management tools improve collaboration between onshore and offshore teams

What results can a hybrid workflow model deliver

Does offshore collaboration increase security risk

Which accounting work is typically supported by offshore teams

How can a firm begin adopting a hybrid workflow model

Start by mapping internal processes into a workflow tool, standardizing templates, and then expanding workload to offshore resources through the tool.

-

Director (CA, CS)

A Chartered Accountant and Company Secretary with over 11 years of experience, Bindesh specializes in direct taxation, estate planning, and statutory compliance. He helps U.S.-focused firms navigate complex tax issues with precision and foresight, while ensuring every SafeBooks engagement meets legal and procedural expectations.