Filing Form 1099 is one of the most important compliance tasks for businesses and accounting professionals. Yet, errors and missed deadlines are common. The IRS issued more than $1.3 billion in 1099-related penalties last year alone, showing how critical accuracy and timing are.

This guide from Safebooks Global explains what needs to be reported, who requires a 1099, and how to prepare your filings for 2025 with confidence.

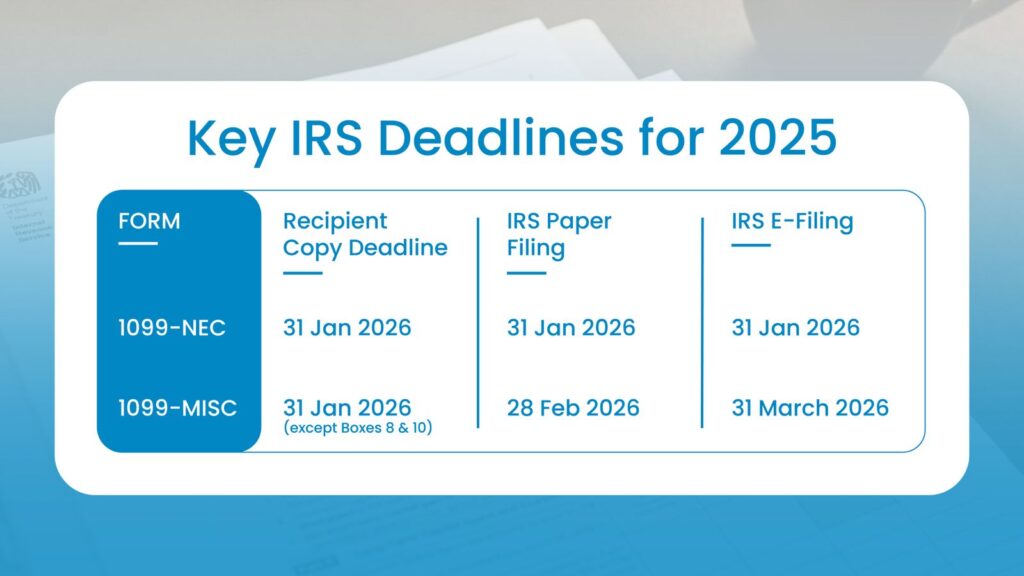

E-filing is mandatory if you submit 10 or more information returns in total.

The new $2,000 reporting threshold for both 1099-NEC and 1099-MISC applies to payments made in 2026 (filed in 2027), not for the 2025 tax year. Read more in the One Big Beautiful Bill tax update.

Who Should Receive a Form 1099

For payments made in 2025 (filed in early 2026), issue a 1099 to any U.S.-based vendor, contractor, or service provider paid $600 or more during the year.

Include:

- Independent contractors and freelancers (1099-NEC)

- Attorneys, regardless of corporate structure

- Landlords receiving rent (1099-MISC)

- Medical and healthcare providers

Payments made through credit cards or PayPal are reported by the processor on Form 1099-K.

If your business is scaling, consider evaluating a remote accounting partner to manage compliance efficiently.

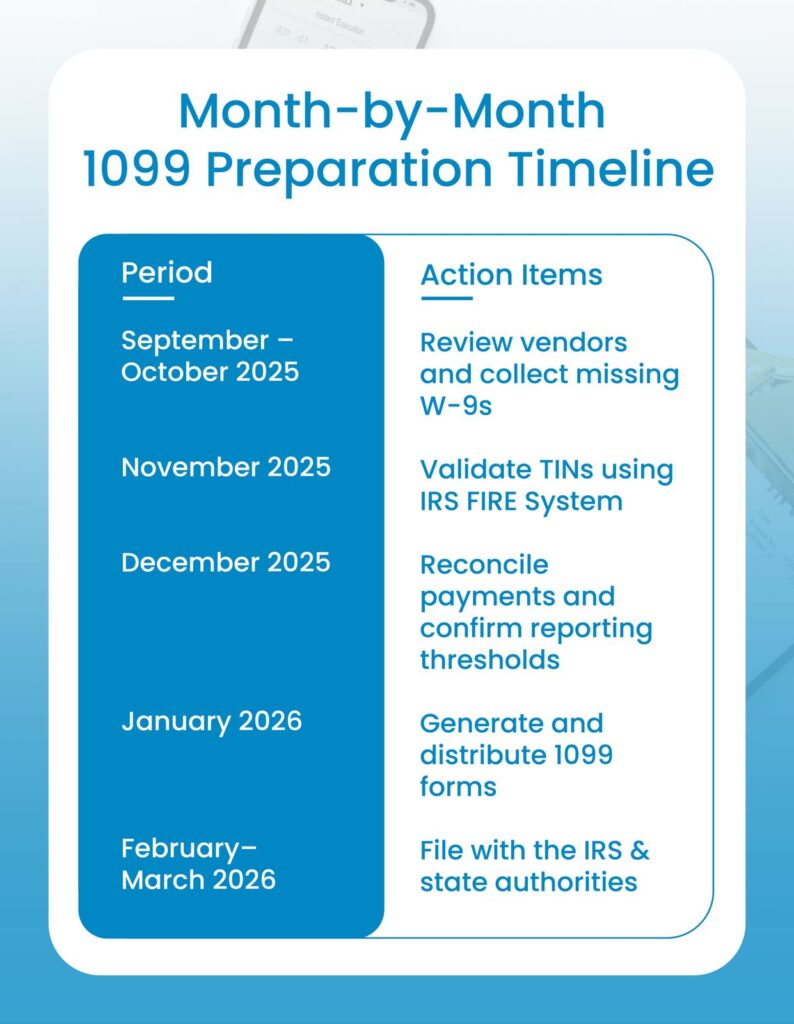

W-9 Collection and Validation

Always collect a Form W-9 before paying a new vendor. The form should include:

- Legal and business name

- Federal tax classification (LLC, partnership, etc.)

- Taxpayer Identification Number (TIN)

Verify all TINs through the IRS TIN Matching Tool under the IRS FIRE System. This can be done interactively (25 names) or in bulk (up to 100,000).

Automating this process through a secure remote accounting workflow setup reduces manual errors and filing delays.

Backup Withholding and Form 945

If a vendor fails to provide a valid W-9 or the TIN doesn’t match IRS records:

- Withhold 24% from reportable payments

- Deposit withheld taxes quarterly

- Report annually using Form 945 (Annual Return of Withheld Federal Income Tax)

While the 24% rate remains the same, the backup withholding threshold will align with the new $2,000 1099 threshold beginning in 2026, as part of the One Big Beautiful Bill Act.

Learn more about related compliance rules in our article on accrued expense deductions.

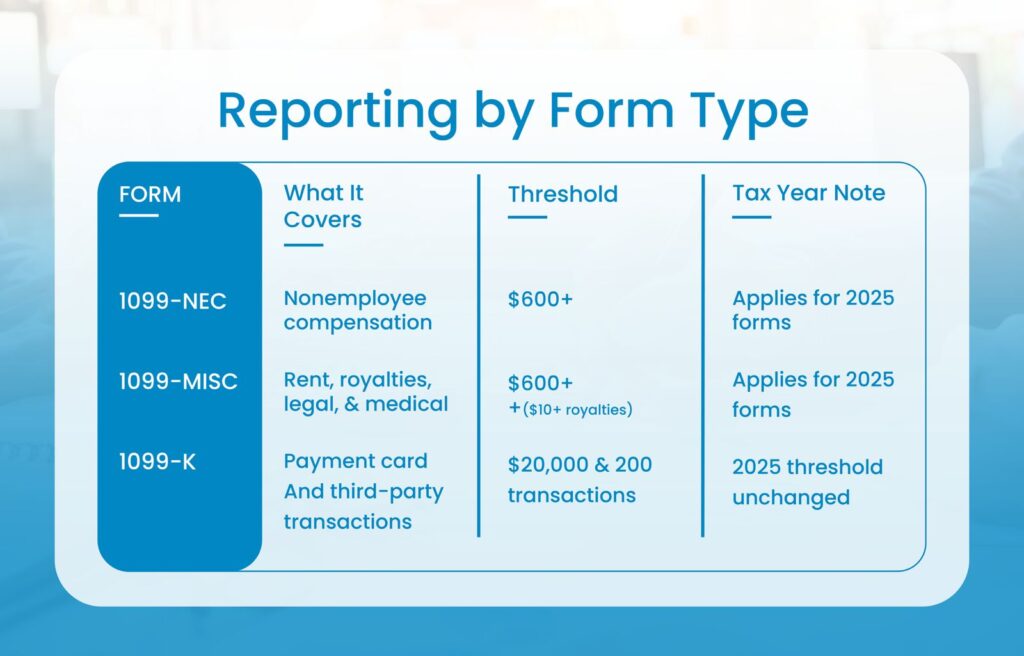

Reporting by Form Type

C-corporations are exempt except for legal and medical payments.

Avoiding Errors and Penalties

Common 1099 mistakes include:

- Reporting to exempt corporations

- Entering incorrect TINs

- Missing medical or legal vendors

If an error occurs:

- Type 1 (amount/code errors): File a corrected form

- Type 2 (TIN/name errors): Void the original form and file a new one

Penalty tiers for late filing:

Correcting early limits penalties and maintains compliance integrity.

State-Level 1099 Requirements

Over 30 states participate in the Combined Federal/State Filing (CF/SF) program, allowing one submission to satisfy both IRS and state obligations. However, certain states—like California, New York, and Pennsylvania—require separate filing.

In total, 43 states maintain some level of 1099 reporting requirement. Learn more in our 2025 SALT compliance guide.

Streamlining 1099 Filing with Technology and Remote Teams

Manual tracking can increase errors and cost firms valuable time. Many businesses now automate 1099 filings using accounting software or trained offshore teams. Automation helps to:

- Track vendor thresholds automatically

- Generate and e-file 1099s directly

- Maintain organized, audit-ready records

You can calculate the savings from remote filing through our Remote Accounting ROI Calculator.

To see how Safebooks maintains data privacy, read how we protect client financial data.

Expert Insight

“Remote teams can handle 1099 compliance as effectively as in-house staff when supported by structured systems, early vendor validation, and monthly reviews.”

– Bindesh Jain

Tax Director, Safebooks Global

Why Firms Choose Safebooks for 1099 Management

Safebooks Global provides remote accounting and compliance support for U.S.-based firms.

We specialize in bookkeeping, payroll, tax preparation, and audit support, with integration across QuickBooks, Xero, Lacerte, and Drake.

Operating from both the U.S. and India, we deliver high-quality, secure, and compliant accounting services backed by over a decade of industry experience.

Explore how AI in tax prep or cash-basis accounting can enhance compliance accuracy and speed.

Contact us to simplify your 1099 compliance and reporting.

FAQS

Do I need to issue a 1099 to vendors paid via PayPal or Venmo?

Are LLCs exempt from 1099s?

What happens if I file late?

How do I report withheld tax?

How can I automate 1099 filings?

Use accounting software or a remote accounting team for W-9 collection, validation, and submission.

-

Director (CA, CS)

A Chartered Accountant and Company Secretary with over 11 years of experience, Bindesh specializes in direct taxation, estate planning, and statutory compliance. He helps U.S.-focused firms navigate complex tax issues with precision and foresight, while ensuring every SafeBooks engagement meets legal and procedural expectations.