Remote Payroll and Sales Tax Filing That Just Works

Why SafeBooks for Payroll, Sales Tax & Compliance

What We Handle?

Payroll Services

- Bi-weekly, monthly, and custom pay runs

- Paystub preparation and delivery

- Direct deposit setup and reporting

- Leave, benefits, and year-end summaries

Payroll Filing

- Federal and state payroll tax submissions

- W-2s and 1099 filings

- Coordination with external CPAs if needed

- Quarterly, annual, and amended returns

Sales Tax (SALT) Support

- State-specific sales/use tax research

- Exemption certificate management

- Workpaper prep for advisory review

- Support with state tax notices

Service Packages

SERVICES

Payroll

Processing

Payroll

Tax Filing

Compliance

& SALT Support

Optional

Add-on Services

Scope of Work

- Process employee payroll weekly, biweekly, or monthly using platforms like Gusto, ADP, or QuickBooks Payroll

- Calculate and process withholdings, garnishments, PTO, and bonuses

- Set up direct deposit and issue paystubs through supported platforms

- Prepare & file payroll tax returns such as 941, 940, and state payroll forms.

- Coordinate with U.S. tax partners for accurate and timely submission.

- Manage quarterly, annual, and amended tax filings.

- Handle W-2, W-3, and 1099 documentation and submissions.

- Ensure compliance with federal and state payroll laws

- Manage registration for new hires and sales tax accounts

- Track nexus thresholds and filing obligations across jurisdictions

- Maintain audit-ready documentation for payroll and sales tax

- Multi-state sales tax registration and filing support.

- New state nexus tracking and compliance monitoring.

- Seasonal or project-based sales tax staffing.

- Integration support with Avalara, Vertex, or TaxJar.

Team Qualifications and Expertise

- B.Com / M.Com with specialization in accounting or HR/payroll

- Some team members with MBA (Finance/HR) or CA Inter for compliance review

- Trained in U.S. Payroll Processing and compliance

- Certified in Gusto, ADP Run, QuickBooks Payroll, and Paychex

- Familiar with IRS circulars, wage laws, and state requirements

- Federal and state payroll tax laws

- Familiar with FLSA, wage rules, classifications, and multi-state nexus

- Reconciliation of 941s, 940s, W-2s, 1099s

- 2 to 6 years managing U.S. payroll for small and mid-sized businesses

- Payroll setup, off-cycle adjustments, year-end tax reporting

- CPA, tax team, and HR coordination

- Strong written communication

- Basic spoken English for calls and reviews

- Responsive and client-friendly communication

- Gusto, ADP, QuickBooks Payroll, Paychex, Zenefits

- Excel/Google Sheets for reconciliations

- SharePoint, Dropbox, Docusign for documentation

- Controlled access to payroll data

- Multi-step internal review before payroll submission

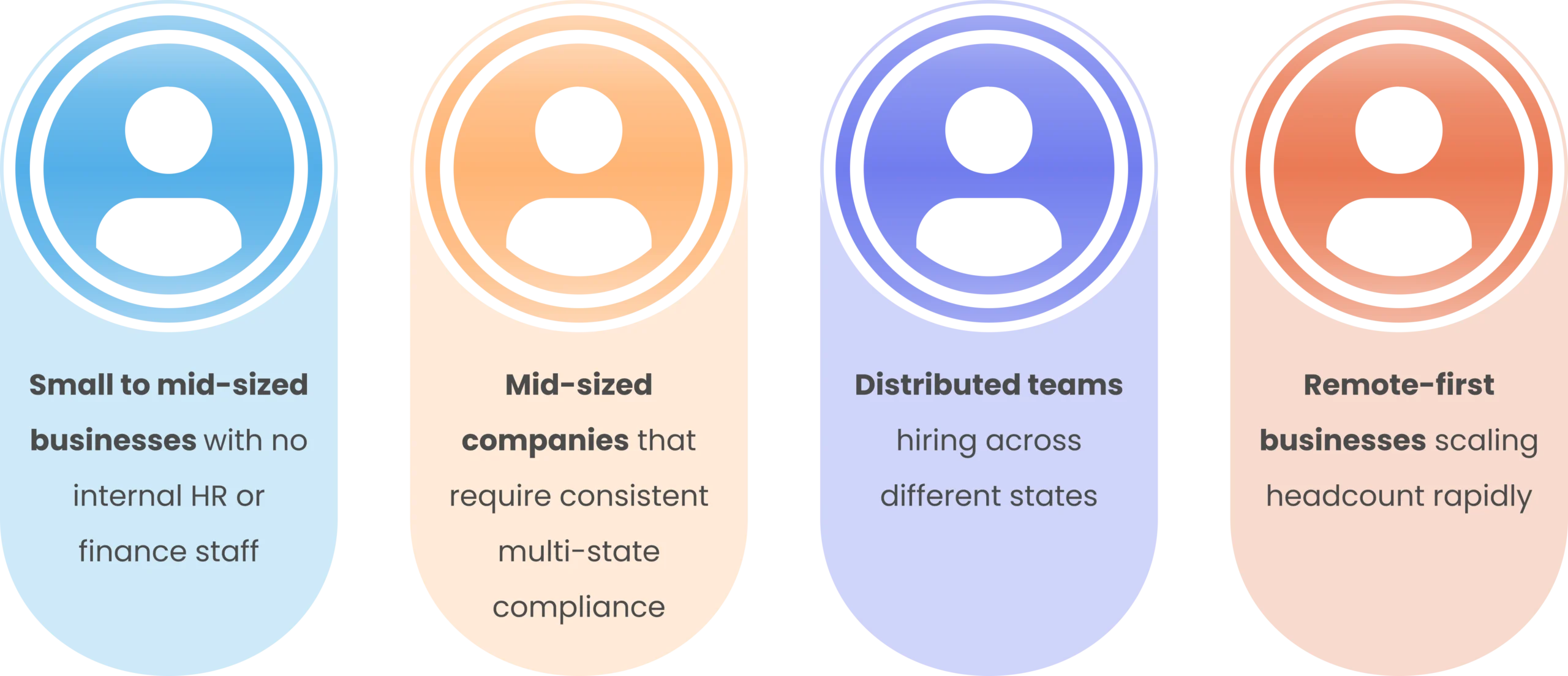

Who We Help?

Software Compatibility

How It Works?

Discovery Call

We assess your setup, headcount, and compliance needs

Transition Plan

We create an onboarding roadmap with tools, timelines, and roles

Payroll & Tax Execution

Your assigned team runs payroll and files taxes in your software

Monthly Reports

Get clear summaries and financial insights delivered regularly.

Review & Recommendations

Includes checklists and action items to improve your processes.

Security & Data Protection

VPN-secured access

256-bit encrypted document exchange

Daily data backups

Role-based access for payroll data

SOC and GDPR compliant

Audit logs available on request

Real Results from Remote Engagements

and compliance

workflows with

measurable outcomes.

Paychecks Processed Monthly

Satisfaction With Compliance Turnaround

Missed Filings Across 40+ Clients

Average Savings on Internal Payroll Cost

Testimonials

Need Support with Bookkeeping, Compliance, or AR/AP?

FAQS

Do you handle multi-state payroll?

Can you integrate with our existing software?

Do you offer tax-only services?

What if we hire in a new state?

We help register your business, obtain state tax IDs, and set up compliance requirements.

Is my employee data secure?

Yes, we follow IRS WISP compliance protocols, use encrypted systems, VPN-secured access, and role-based permissions.