Bookkeeping That

Keeps Pace With Your Business

Real-time, remote-first accounting support for growing businesses and small to mid-sized companies that need visibility, accuracy, and scale without building an in-house team.

Why Remote Works for Modern Business?

Avoid hiring delays

& get a trained

team within days.

Save 40–60% on

finance without

adjusting quality.

Stay on top of daily

reconciliation, monthly

close, & financial clarity.

Integrate

seamlessly your

tools & internal

review cycles.

Build scalable

workflows from

day one.

What We Handle?

Reliable support across recurring accounting tasks and reporting cycles.

Daily & Weekly Tasks

- General ledger entries and reconciliations.

- Accounts(Payable & Receivable) management support.

- Invoice creation and receipts tracking.

- Real-time data entry into QuickBooks, Xero, Zoho Books, etc.

Monthly & Quarterly Tasks

- Month-end close including balance sheet, P&L, and cash flow.

- Journal entries and accruals.

- Working capital and variance reports.

- Budget vs actual tracking and review.

Annual & Strategic Support

- Year - end support for tax readiness.

- Integration with CPA or tax advisor workflows.

- Custom financial dashboards or reports.

Service Packages

Clear, flexible accounting services to support your business at every stage.

SERVICES

Accounting & Bookkeeping

Year-End

Accounting

Monthly

Bookkeeping

Virtual CFO

Support Services

Scope of Work

- Record all financial transactions and maintain the general ledger using QuickBooks, Xero, or any books of accounts management software.

- Perform bank, credit card, and loan account reconciliations monthly.

- Maintain accounts payable and receivable ledgers, including vendor & client aging reports.

- Generate basic monthly financial statements and reports including P&L, Balance Sheet, and Cash Flow.

- Add-ons: Payroll processing, sales tax filings, and catch-up bookkeeping available upon request.

- Review and clean up the year’s transactions and reconciliations

- Adjust journal entries for depreciation, accruals, and closing balances

- Prepare year-end financial statements and trial balance for tax filing or audit

- Coordinate with CPA or tax preparers to ensure books are tax-ready

- Ideal for tax season or businesses that need books finalized for compliance and reporting

- Record monthly income and expenses and categorize transactions.

- Reconcile bank and credit card accounts at month-end

- Maintain up-to-date ledgers for AR and AP tracking

- Provide a monthly financial report package including P&L and Balance Sheet

- Includes email support and one review call per month. Scalable based on transaction volume

- Provide monthly financial analysis with insights & trend reporting.

- Develop cash flow forecasting, budgeting, and scenario planning.

- Offer strategic financial advisory for decision-making, pricing, cost control, and investments

- Conduct monthly or quarterly review calls to guide business owners on KPIs and financial health

- Includes customized dashboards and report packages. Best suited for growing or scaling businesses.

Team Qualifications and Expertise

Professionals trained in U.S. standards with hands-on experience across finance functions.

- Bachelor’s or Master’s degree in Accounting, Commerce, or Finance (B.Com / M.Com)

- CA Inter, Chartered Accountants, or CPA-track professionals for key review tasks

- Certified QuickBooks ProAdvisors and Xero Certified professionals

- Ongoing training in U.S. GAAP, accounting standards, and tax regulations

- Gusto, Bill.com, Dext, Hubdoc, Melio

- 2 to 8+ years handling U.S.-based clients across industries.

- Experience with monthly bookkeeping, year-end finalization, reconciliations, & clean-ups.

- Collaboration with CPAs, EAs, U.S. tax teams, and accounting firms for small and mid-size businesses

- Good written communication for reporting and queries

- Functional spoken English for meetings and calls

- Responsive and client-friendly communication

- Skilled in dashboards, forecasts, budgets, and performance reviews

- Advised SMBs on cash flow, KPIs, and cost control

- Proficient in QuickBooks, Xero, and cloud-based platforms

- Comfortable with Slack, Teams, Trello, and CRMs

- Strong in spreadsheet modeling using Excel and Google Sheets

- Internal multi-level review led by Senior Accountants and Team Leads

- Periodic quality checks for compliance, accuracy, and timely delivery

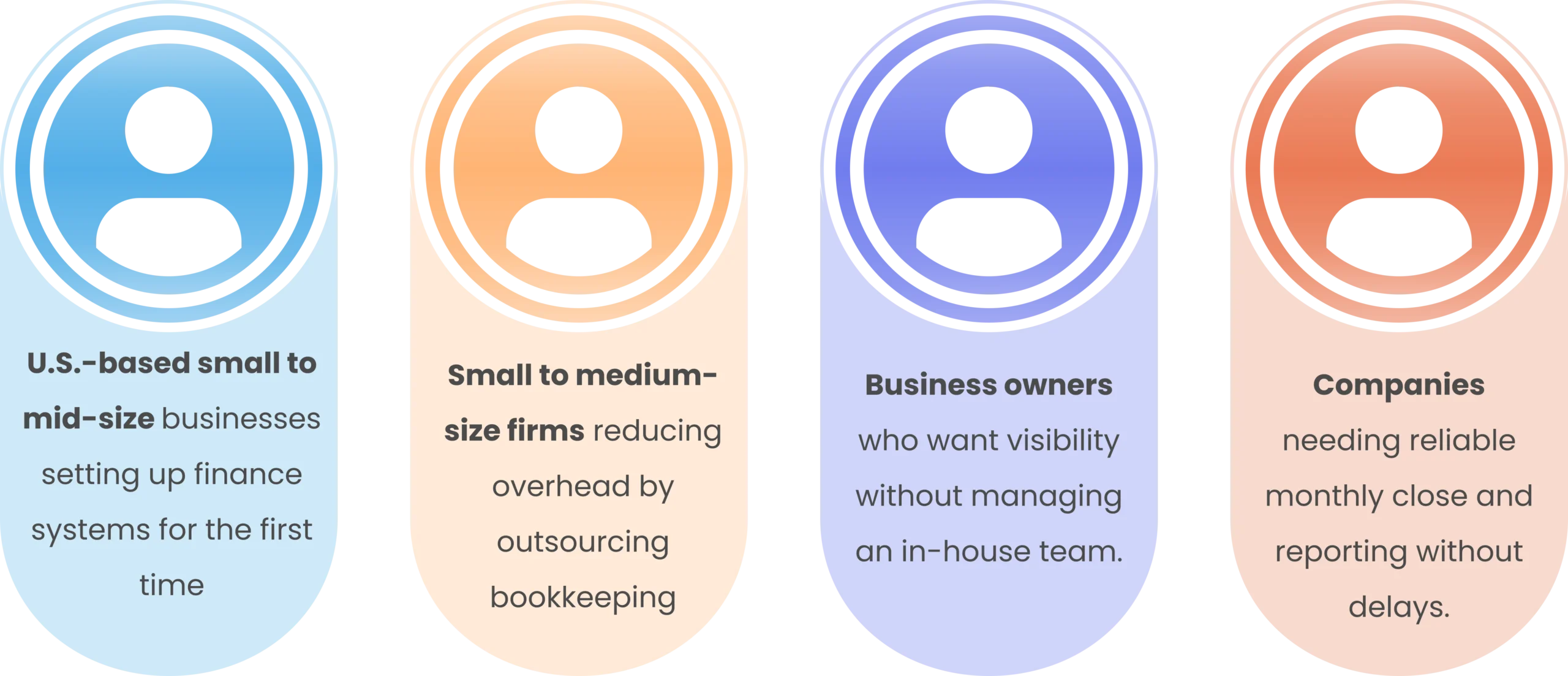

Who We Help?

Flexible support built for small teams and growing businesses.

Software Compatibility

We work inside your accounting stack, not outside it.

How It Works?

Our 5-Step Remote Accounting Model

Discovery Call

Understand your business structure and finance needs.

Custom Proposal

Design a role or service package specific to your business.

Onboarding & Setup

Assign and introduce your remote accountant.

Workflow Integration

Begin working inside your systems and timelines.

Continuous Reporting

Deliver consistent updates, reports, and support.

Security & Data Protection

Enterprise-grade infrastructure to protect your data, ensure privacy, and support secure remote accounting operations, built for compliance and peace of mind.

VPN-only access to client platforms.

256-bit encrypted data handling.

USB and print-disabled workstations.

SOC & GDPR-aligned compliance framework.

Daily backups, logs & role-based permissions.

NDAs & compliance sign-off by team members.

Real Results from Remote Engagements

Consistent

performance backed

by process, speed, and

scale.

performance backed

by process, speed, and

scale.

0

%

Average cost

reduction

0

%

Accuracy across

files

0

x

Faster turnaround

during tax season

0

K+

Monthly transactions

handled

Testimonials

Consistent. Compliant. Trusted.

SafeBooks gave us a finance team overnight. Now we focus on growth while they manage the numbers.

Safebooks Global cleaned up our books and now everything runs smoothly. I finally have financial clarity and peace of mind.

Our month-end close is now predictable and stress-free. Reports arrive on time, and every number ties out perfectly.

They integrated seamlessly with our existing systems and now handle everything from reconciliations to management reports.

With their Virtual CFO insights, I now make data-driven decisions instead of relying on guesswork.

Need Support with Back-office support, Compliance, or AR/AP?

We offer add-on services to complete your finance function, file taxes, stay compliant, and manage payables & receivables.

FAQS

What’s the difference between remote and outsourced bookkeeping?

Remote means we work inside your systems and processes just like an in-house team, only offshore.

Can I get a dedicated accountant instead of a team?

Yes, we assign a dedicated accountant who acts as your point of contact and manages your books regularly.

Do you help with cash flow tracking or just basic entries?

We do both. Our services include cash flow tracking, forecasting, and budgeting through Virtual CFO support.

What if we use multiple platforms like QuickBooks and Excel dashboards?

That’s absolutely fine. We’re comfortable working across tools and can manage integrated workflows.

Do your team members work U.S. hours?

While we may not match full U.S. business hours, we do align for at least 4–5 hours of common working time for smooth collaboration.

Can you assist with year-end tax readiness?

Yes. We prepare reconciliations, clean up books, and coordinate with your CPA or tax preparer so your books are tax-ready.

Ready to Build Your Remote Accounting Team?

Let’s get started with your custom staffing solution today.